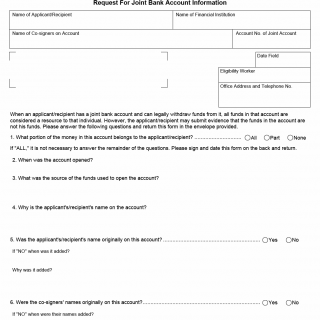

TX HHS Form H1299. Request for Joint Bank Account Information

Form H1299 is used by the Texas Health and Human Services Commission (HHSC) to collect detailed information about a joint bank account held by an applicant or recipient of public assistance. The form helps determine whether funds in a jointly held account should be counted as a financial resource when evaluating eligibility for benefits.

Purpose of Form H1299

The main purpose of Form H1299 is to clarify ownership of funds in a joint bank account. Under Texas and federal eligibility rules, if an applicant or recipient can legally withdraw money from a joint account, HHSC generally treats the full balance as that person’s resource. This form gives the applicant or recipient an opportunity to show that some or all of the funds belong to someone else.

The information provided is used by eligibility workers to make accurate benefit determinations and prevent incorrect approval or denial of assistance.

When This Form Must Be Submitted

Form H1299 is required when an HHSC applicant or recipient has a joint bank account and that account may affect eligibility for benefits. Common situations include:

- An applicant applies for Medicaid, SNAP, or other assistance and is listed on a joint bank account

- An eligibility review identifies a joint account with available funds

- A recipient disputes HHSC’s assumption that all joint funds belong to them

The form is generally not required if the applicant clearly owns all funds in the account and confirms this on the form.

Who Is Allowed to Complete the Form

The form must be completed and signed by the applicant or recipient whose eligibility is being evaluated. Any co-signers listed on the account are also required to sign the form to confirm the accuracy of the information provided.

An HHSC eligibility worker completes internal fields such as the date, office information, and case details.

Explanation of Each Key Section

Applicant and Account Information

This section identifies the applicant or recipient, the financial institution, the joint account number, and the names of all co-signers. Accurate identification is essential to link the account to the correct case.

Ownership of Funds

The form asks whether all, part, or none of the funds belong to the applicant or recipient. If “All” is selected, no further questions are required and the account is treated as fully owned by the applicant.

Account History

These questions cover when the account was opened, the source of the initial funds, and why the applicant’s name appears on the account. This information helps HHSC understand the intent behind the account setup.

Co-Signer Information

This section documents when and why co-signers were added and whether they were original account holders. It helps establish whether the account is shared for convenience or true joint ownership.

Deposits and Withdrawals

The form requires details on who deposits money, who withdraws money, and how withdrawn funds are used. These patterns are often critical in determining actual ownership.

Interest and Current Ownership Amount

Applicants must explain how interest is handled and state what portion of the account balance they claim as their own.

Redesignation Requirement

If the applicant successfully disproves ownership of all funds, the account must be redesigned to remove their access. Documentation of redesignation must be provided to HHSC.

Statement of Responsibility and Signatures

This section warns about penalties for fraud and requires signatures from the applicant and co-signers, confirming that all information is true and complete.

Practical Tips for Completing Form H1299

- Answer all questions clearly and consistently.

- Ensure deposit and withdrawal amounts align with bank statements.

- Include explanations that match how the account is actually used.

- Provide redesignation documents promptly if required.

- Keep copies of everything submitted to HHSC.

Common Mistakes to Avoid

- Leaving sections blank when “Part” or “None” is selected

- Providing answers that conflict with bank records

- Failing to obtain co-signer signatures

- Claiming funds are not owned without redesignating the account

- Ignoring interest earned on the account

Legal and Regulatory Context

Form H1299 is governed by HHSC eligibility rules that treat accessible joint bank funds as available resources. These rules are designed to ensure accurate assessment of financial eligibility and to prevent improper benefit payments. Providing false or incomplete information may result in denial of benefits, overpayment recovery, or criminal penalties.

Real-Life Examples of Use

- An elderly applicant is listed on an adult child’s bank account for emergency access only.

- A recipient shares an account with a spouse but contributes only a small portion of the funds.

- An applicant is added to a parent’s account temporarily to help manage bills.

Documents Commonly Submitted With This Form

- Bank statements showing deposits and withdrawals

- Account opening documents

- Redesignation or removal paperwork from the bank

- Written statements explaining account use

Frequently Asked Questions

Does HHSC count all joint account funds by default?

Yes, unless ownership is successfully disproved.

What happens if I claim only part of the funds?

HHSC reviews the details to determine the countable amount.

Do co-signers have to sign the form?

Yes, co-signer signatures are required.

Is redesignation always required?

Yes, if ownership of funds is disproved.

Can benefits be denied based on this form?

Yes, if countable resources exceed limits.

What if information is incorrect?

HHSC may request corrections or take action based on discrepancies.

Related Forms

- Resource Declaration Forms

- Bank Verification Requests

- Eligibility Review Forms

Form Details

- Form Name: Request for Joint Bank Account Information

- Form Number: H1299

- Agency: Texas Health and Human Services Commission

- State: Texas

- Revision Date: November 2017