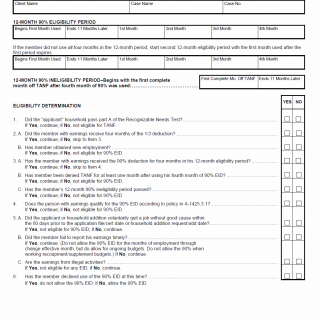

TX HHS Form H1104. 90% Earned Income Deduction (EID) Eligibility and Tracking

The TX HHS Form H1104, "90% Earned Income Deduction (EID) Eligibility and Tracking", helps determine eligibility for the 90% EID program. This form is used in situations where individuals need to track their earned income deduction and ensure they meet specific requirements to qualify for the program.

The form guides users through a series of questions and conditions to determine eligibility, including checks on recognizable needs test, employment status, and reporting of earnings. Key features include required information such as applicant household details and earnings records, as well as follow-up actions like determining ineligibility periods and tracking 12-month eligibility cycles.

Some key points to note when using this form include:

- The 90% EID program has a specific eligibility period that begins with the first month used and ends 11 months later.

- Eligibility is determined by meeting certain conditions, such as passing the recognizable needs test and receiving four months of the 1/3 deduction.

- The form also tracks ineligibility periods, including situations where individuals have been denied TANF for at least one month after using their fourth month of 90% EID.

Geo:

Institution:

SourcePage:

https://www.hhs.texas.gov/regulations/forms/1000-1999/form-h1104-90-earned-income-deduction-eid-eligibility-tracking