TX HHS Form H1079. Qualifying Quarters of Social Security Earnings

The TX HHS Form H1079, Qualifying Quarters of Social Security Earnings, is a crucial document that helps determine the 40 qualifying quarters of social security earnings. This form is typically used in situations where an individual's work history needs to be verified for social security purposes.

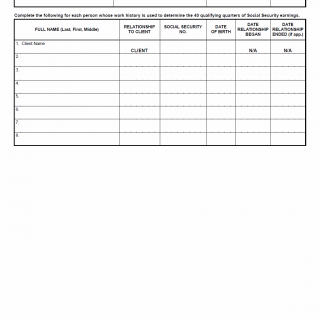

To complete this form, you must provide required information about each person whose work history is being used to determine their qualifying quarters. This includes the client's name, date range of employment, and relationship to the client. The form also specifies that the full name should include the last, first, and middle names.

The key features of this form are the required information fields and the specific instructions for completing each section. By following these guidelines, you can ensure that your social security earnings are accurately determined. Here are some key points to keep in mind:

- This form is used to determine the 40 qualifying quarters of social security earnings.

- The form requires information about each person whose work history is being used for social security purposes.

- The full name should include the last, first, and middle names.