TX HHS Form H1019. Report of Change

Form H1019, issued in October 2024, is the official Texas Health and Human Services Commission (HHSC) document for reporting changes that may affect your benefits. This form ensures that households receiving TANF, Medicaid, CHIP, Healthy Texas Women, or SNAP benefits maintain accurate and up-to-date information with the state. Timely reporting helps prevent overpayments, penalties, or interruptions in benefits.

Purpose of Form H1019

The form is designed to capture all relevant changes in a household's circumstances, including income, household composition, assets, and personal details. Reporting these changes within 10 days is mandatory, and failure to do so can have legal and financial consequences.

Key Sections of Form H1019 and Expert Guidance

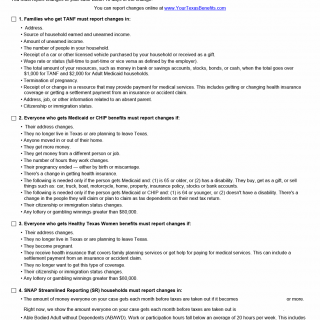

1. Reporting Changes for TANF Recipients

This section covers mandatory reporting for families receiving Temporary Assistance for Needy Families (TANF). Key areas include:

- Address changes

- Sources and amounts of earned or unearned income

- Household size changes

- Receipt of vehicles or other gifts

- Wage rate or employment status changes

- Total household resources exceeding set thresholds

- Pregnancy terminations or resource changes impacting medical coverage

Expert Tip: Always attach documentation for income or asset changes to prevent delays or denials.

2. Reporting Changes for Medicaid and CHIP Beneficiaries

All recipients must report changes affecting eligibility, including:

- Address or residence changes

- Income changes or new sources of income

- Pregnancy status changes

- Health insurance coverage changes

- Citizenship or immigration status changes

Common Mistake: Forgetting to report a new dependent or additional income can trigger overpayment recovery.

3. Reporting for Healthy Texas Women Program

Changes such as new pregnancies, address updates, or insurance coverage must be reported. Failing to report can disrupt services for family planning or other health benefits.

4. SNAP Reporting Requirements

The form differentiates between streamlined reporting (SR) and non-streamlined households. Key responsibilities include:

- Monthly income and wage reporting

- Address and housing cost changes

- Changes in household composition

- Asset or resource changes above thresholds

- ABAWD work-hour compliance

- Lottery or gambling winnings above limits

Expert Tip: Keep copies of all receipts and proof of changes to avoid disputes or penalties.

5. Proof of Changes and Submission

Proof can be uploaded online, mailed, or faxed. Another person may submit the report on your behalf. Always request a receipt to confirm submission.

6. Voter Registration and Privacy Notices

The form includes optional voter registration information. Submission or declination does not affect benefits. Users also retain rights under Government Code Sections 552.021, 552.023, and 559.004 to access and correct personal data held by HHSC.

Practical Tips for Completing Form H1019

- Report all changes within 10 days to stay compliant.

- Attach supporting documents whenever possible.

- Keep copies for your records to avoid disputes.

- Use online submission for faster processing.

- Double-check entries for accuracy to prevent delays.

Real-Life Examples

- A TANF recipient moved to a new apartment and updated their address within 5 days, ensuring uninterrupted benefits.

- A Medicaid beneficiary received an unexpected bonus; reporting it promptly prevented overpayment recovery.

- An SNAP household sold a vehicle exceeding $4,250; timely reporting avoided penalties and preserved eligibility.

- A Healthy Texas Women participant became pregnant and updated insurance coverage, maintaining uninterrupted health services.

Documents You May Need to Attach

- Proof of income (pay stubs, employment letters)

- Bank statements or account summaries for asset reporting

- Vehicle or property documentation

- Health insurance documents

- Official notices regarding household composition or employment changes

Frequently Asked Questions (FAQ)

- Who must submit Form H1019? Any household receiving TANF, Medicaid, CHIP, Healthy Texas Women, or SNAP benefits experiencing changes.

- What is the reporting deadline? Changes must be reported within 10 days of occurrence.

- Can someone else report on my behalf? Yes, with your authorization.

- What happens if I fail to report? You may owe repayment, lose benefits, or face penalties including fines and imprisonment for fraud.

- Can I submit online? Yes, at www.YourTexasBenefits.com.

Micro-FAQ

- Purpose? To report changes affecting benefits.

- Who files? Any benefit recipient or authorized representative.

- Deadline? Within 10 days.

- Attachments? Proof of income, assets, or household changes.

- Submitted to? Texas HHSC.

- Penalties? Repayment or legal consequences for false reporting.

- Voter registration? Optional; does not affect benefits.

- Online reporting? Available at www.YourTexasBenefits.com.

Related Forms

- TANF Application Form

- Medicaid/CHIP Application Form

- SNAP Combined Application Form

- Healthy Texas Women Program Enrollment

- Texas Health and Human Services Updates

Form Details

- Name: Report of Change

- Number: Form H1019

- Region: Texas

- Date: October 2024