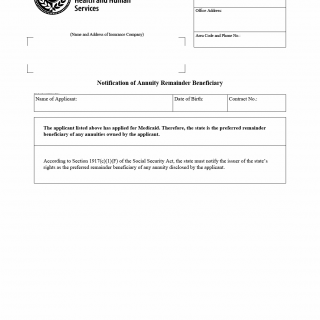

TX HHS Form H0059. Notification of Annuity Remainder Beneficiary

This document is used by Texas Health and Human Services (HHS) to formally notify an insurance company that the State of Texas must be listed as the preferred remainder beneficiary on an annuity owned by a Medicaid applicant. Although the form itself is short, its implications are significant, because it affects eligibility for long-term care Medicaid and determines who receives remaining annuity funds after the annuitant’s death.

Purpose and Function of the Form

Under federal law, specifically Section 1917(c)(1)(F) of the Social Security Act, states are required to recover Medicaid costs from certain assets, including qualifying annuities. When someone applies for Medicaid long-term care benefits in Texas, any annuity in their name must list the State of Texas as the preferred remainder beneficiary. Form H0059 is the official notice that communicates this requirement to the insurance company that issued the annuity.

In practice, the form ensures that Texas HHS can evaluate Medicaid eligibility correctly and that the state can recover funds after the beneficiary’s death as required by federal Medicaid Estate Recovery Program (MERP) rules.

Explanation of Key Sections

Applicant Information

This section identifies the Medicaid applicant by name, date of birth, and the annuity contract number. Because Medicaid eligibility hinges on accurate financial disclosures, even a small error—such as misstating the contract number—can delay or jeopardize the application.

Insurance Company Details

The form includes the name and address of the annuity issuer. Texas HHS uses this information to notify the insurer directly of the state’s beneficiary rights. If the wrong insurer is listed, the notification will not be legally effective.

Legal Basis Statement

This part cites Section 1917 of the Social Security Act, which mandates that states notify annuity issuers of Medicaid recovery rights. It is a formal reminder that annuities affect Medicaid eligibility and must comply with federal recovery requirements.

When This Form Is Required

- The applicant owns an annuity and applies for Medicaid long-term care services.

- The applicant is renewing Medicaid eligibility and has recently purchased or modified an annuity.

- Texas HHS discovers previously undisclosed annuities during a financial review.

The form is not required if the applicant does not own any annuities. It is also not used for non-Medicaid programs such as SNAP or TANF.

Who Has the Right to Complete or Submit the Form

- The Eligibility Specialist assigned to the applicant’s Medicaid case.

- The applicant or their authorized representative (if HHS requests supporting details).

- An attorney or financial professional assisting with Medicaid planning (as long as the applicant has given authorization).

The applicant themselves does not choose the beneficiary designation—the requirement comes from federal law.

Documents Commonly Attached

- A copy of the annuity contract

- Statements confirming ownership and current value

- Any amendments or riders recently added to the annuity

- Proof of the applicant’s identity (if requested)

Submitting incomplete documentation is one of the most common reasons for delays in processing Medicaid eligibility.

Typical Mistakes Applicants Make

- Failing to disclose an annuity during the Medicaid application.

- Confusing life insurance contracts with annuities.

- Listing the wrong contract number or insurer name.

- Not updating beneficiary information after a spouse dies.

Any of these issues can cause the application to be denied or delayed.

Legal and Practical Consequences

If the applicant does not comply with annuity disclosure requirements or refuses to update the remainder beneficiary, Texas HHS can treat the annuity as a resource or an improper transfer—both of which may make the applicant ineligible for long-term care Medicaid.

Once the applicant passes away, the remaining annuity funds (after certain allowable deductions) may be recovered by the State of Texas to repay Medicaid expenses under MERP rules.

Real-World Examples

- Example 1: A 76-year-old nursing home applicant owns an immediate annuity purchased ten years ago. The insurer must be notified that Texas is now the preferred remainder beneficiary.

- Example 2: A caregiver applies for Medicaid on behalf of their mother and discovers an old deferred annuity that had been forgotten. H0059 is used to notify the insurance company.

- Example 3: A financial planner assists a client preparing for Medicaid eligibility. The planner uses Form H0059 to ensure the insurer updates the state’s beneficiary designation.

Practical Filing Tips

- Double-check the annuity contract number—it must match exactly.

- Submit the form promptly to avoid delays in Medicaid approval.

- If the insurer requests additional documentation, provide it immediately.

- Keep a copy of the completed form for your records.

Documents You May Need

- Annuity contract and issue date

- Statement of current value

- Identification documents

- Power of attorney papers, if acting for the applicant

FAQ

- Why does Texas have to be listed as the remainder beneficiary? Federal law requires states to recover Medicaid long-term care costs from certain assets, including annuities.

- Will this affect my monthly annuity payments? No. It affects only the remaining value after the annuitant’s death.

- Does this make my annuity invalid? No, it only updates the beneficiary designation for Medicaid compliance.

- Is this required for all annuities? It is required for annuities owned by Medicaid long-term care applicants or their spouses.

- What happens if the insurer refuses to update the beneficiary? Texas HHS may count the annuity as a disqualifying asset, which can lead to ineligibility.

- Do I need a lawyer? Not necessarily, though applicants with complex financial arrangements often consult one.

- Is the form submitted by the applicant? Usually it is prepared or sent by the Eligibility Specialist.

Micro-FAQ (Short Answers)

- Purpose: Notify insurer that Texas must be the preferred remainder beneficiary.

- Who files: Texas HHS or the Eligibility Specialist.

- When needed: When a Medicaid applicant owns an annuity.

- Deadline: During the Medicaid eligibility process.

- Attachments: Annuity contract and recent statements.

- Submitted to: The annuity issuer/insurance company.

- Consequence of not filing: Possible Medicaid ineligibility.

- Affects payments? No, only remainder distribution.

- Regulated by: Section 1917(c)(1)(F) SSA.

Related Forms

- Texas Medicaid Application (Form H1200)

- Applicant’s Statement of Income (Form H0003)

- Medicaid Estate Recovery Program Notice

Form Details

- Form Name: Notification of Annuity Remainder Beneficiary

- Form Number: H0059

- Jurisdiction: State of Texas

- Issued by: Texas Health and Human Services

- Edition Date: 07-2020