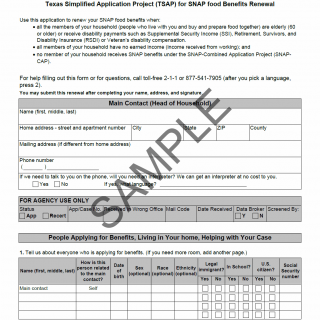

TX HHS Form H0011-R. Texas Simplified Application Project (TSAP) for SNAP Food Benefits Renewal

This page explains Form H0011-R (Texas Simplified Application Project — TSAP) used to renew Supplemental Nutrition Assistance Program (SNAP) benefits under special simplified rules. The renewal targets households made up entirely of elderly (60+) or people receiving disability payments and with no earned income. Below you will find a clear, practical guide to what the form asks, who should file it, common pitfalls, what to attach, and concise answers to frequent questions.

Purpose and When to Use This Form

Form H0011-R is a renewal application. Use it when your household meets the TSAP renewal conditions: every household member is elderly or receives disability payments (SSI, RSDI, Veteran’s disability compensation), the household has no earned income, and no member receives SNAP via SNAP-CAP. The form is designed to speed up renewals for households that are usually eligible without detailed monthly income checks.

Who Can Complete and Submit the Form

The main contact (head of household) typically completes the form. An authorized representative may act for the household if you designate one and provide proof of representation. Applicants include U.S. citizens and certain categories of legal immigrants as set out in program rules; children who are U.S. citizens can be included even if an adult household member is not a citizen.

How the Form Is Submitted

You can submit the renewal by mail or fax to the addresses on the form (HHSC PO Box or fax number). The form also notes phone and online options (YourTexasBenefits.com and the mobile app) for reporting changes, but the printed renewal may be mailed or faxed if preferred. Contact lines (2-1-1 or 877-541-7905) are provided for help.

Section-by-Section Explanation

Main Contact and Address

This section collects the head of household’s name, home and mailing address, county, and phone. It also asks whether an interpreter is needed. Accuracy here is essential: HHSC uses this information to contact you about your case.

People Applying and Household Composition (Questions 1–2)

List everyone applying for benefits and other household members who live with you. The form stresses that every person in the home must be listed in either question 1 or 2. Missing household members or incorrect relationships can lead to delays or eligibility errors.

Authorized Representative (Question 3)

If you want someone else to act for you — to provide facts, report changes, or appeal decisions — you must name that person and, in some cases, include proof of legal appointment. You may have only one authorized representative for all HHSC benefits.

Program Compliance and Disqualifications (Questions 4–7)

These questions ask about prior disqualifications from TANF or SNAP, felony drug convictions after September 1, 2015, convictions of certain sexual crimes, fleeing law enforcement, and probation/parole violations. Any “yes” answers usually require explanation and may affect eligibility or trigger additional review.

Assets and Resources (Questions 8–10)

Report lottery or gambling winnings, cash on hand, checking and savings balances, and vehicle ownership. Vehicle details are required because vehicle ownership and the amount owed can affect benefit calculations in some cases.

Income and Money Coming Into the Home (Questions 11–13)

List any payments from jobs, training, pensions, SSI, Social Security (RSDI), veteran benefits, and other income, including informal cash support from relatives or friends. Even if your household typically has no earned income, other income types must be reported.

Household Costs and Medical Expenses (Question 14 and Medical Costs)

Report monthly bills and any medical costs over $35 per month that are not covered by Medicaid, Medicare, or other insurance. Proof of medical expenses may be required to count those costs toward eligibility or benefit calculation.

Civil Rights, Privacy, and Information Sharing

The form explains nondiscrimination protections, alternate formats for people with disabilities, and how HHSC shares data with federal and state agencies for eligibility verification and program integrity checks. It also clarifies SSN reporting rules and the limited use of SSNs.

Signatures and Certification

The applicant certifies under penalty of perjury that the information provided is true. A witness signature is required only if the main contact signs with an X. Authorized representatives also sign where indicated. Missing or unsigned renewals can be returned as incomplete.

Practical Recommendations for Filling the Form

- Complete all name, address, and signature fields before submitting — the form allows submission once these are done.

- List every household member either in section 1 or 2; do not omit people who live in the home.

- If claiming medical expenses over $35/month, attach proof (receipts, statements) showing the expense and that it is not paid by insurance.

- If an authorized representative will submit or act, include proof of appointment and ensure their contact details are correct.

- Provide Social Security numbers for those applying for benefits; lack of SSN for an applicant can result in denial for that person.

- If signing with an X, have a witness complete the witness signature line to avoid processing delays.

- Keep copies (or photos) of everything you send and note the date of mailing or fax submission.

Typical Mistakes and How to Avoid Them

- Omitting household members or listing someone twice — double-check lists before sending.

- Failing to include required proof (SSN, medical receipts, proof of income) — review the attachments checklist.

- Incorrect vehicle information — include make, model, owner names, year, and amount owed.

- Unsigned forms or missing witness signatures — sign in the correct places and have a witness if needed.

- Not reporting changes within 10 days — promptly report lottery winnings, new income, or household changes.

Examples: Real-World Situations Where H0011-R Is Used

- Elderly couple with fixed benefits: An elderly couple receiving Social Security and no earned income uses H0011-R to renew SNAP because both are over 60 and meet TSAP criteria.

- Disabled adult in single-income home: A household where the adult receives SSI and has no earned income uses this simplified renewal form to avoid a full recertification.

- Authorized representative filing on behalf of a client: A caseworker with proof of appointment submits the form and attaches necessary medical receipts and SSNs for the household.

- Change in non-earned income: A household reports small interest income; they use H0011-R to renew but include documentation about the interest to prevent discrepancies.

Documents You May Need to Attach

- Proof of identity and Social Security numbers for persons applying for benefits (if available).

- Proof of disability payments (SSI, RSDI, veteran disability) or other non-earned income documentation.

- Receipts or statements proving medical expenses over $35/month not paid by insurance.

- Proof of authorized representative status (if someone is filing or acting for you).

- Bank statements or documentation of cash, checking or savings balances, if requested.

- Vehicle documentation showing ownership, co-owners, year, make and model, and amount owed.

Lawful Requirements and Program Rules (Context)

The form implements federal and state rules governing SNAP and related benefits. It references the Food and Nutrition Act (federal rules) for eligibility, verification, and penalties for misuse. Texas Health and Human Services Commission (HHSC) uses federal regulations (for example, 7 C.F.R. parts governing SNAP) and state program rules to verify facts, share data with other agencies, and enforce program integrity. The form’s questions about felony convictions, trafficking, and controlled substances reflect statutory disqualifications and criminal penalties under federal law.

What Happens After You Submit

HHSC will review the renewal and may verify facts through computer matching, employer checks, or other sources. If information does not match, HHSC may request additional documentation or schedule an interview. If approved, your benefits are renewed; if discrepancies are found, benefits may be reduced, delayed, or denied, and overpayments or penalties may be pursued where appropriate.

Extended Frequently Asked Questions (FAQ)

When is Form H0011-R the correct renewal form?

Use H0011-R when all household members are elderly (60+) or receive qualifying disability payments, the household has no earned income, and no member receives SNAP via SNAP-CAP.

Can someone else fill out and submit the form for me?

Yes — you may name an authorized representative who can act on your behalf. Include proof of representation when required and ensure the representative signs where indicated.

Do I have to provide Social Security numbers for everyone on the form?

SSNs are required for persons applying for benefits. Providing SSNs is voluntary but failure to provide an applicant’s SSN may result in denial of benefits for that person.

What proof should I attach for medical expenses?

Attach receipts, bills, or statements showing medical costs over $35/month that are not covered by Medicaid, Medicare, or insurance. These documents help HHSC consider medical deductions where applicable.

How soon must I report changes after filing?

You must report changes within 10 days of knowing about them — for example, lottery winnings or new income — to avoid potential penalties or overpayment recovery.

What are the consequences of providing false information?

Intentional misstatements or trafficking of benefits can lead to criminal prosecution, fines, imprisonment, disqualification from the program, and repayment obligations, as explained on the form.

Where do I send the completed form?

Mail to the HHSC PO Box listed on the form or fax to the provided fax number. Use the contact numbers on the form if you need help completing or submitting the renewal.

Micro-FAQ (Ultra-Short Answers for Quick Reference)

- Purpose: Renew SNAP for elderly/disabled, no earned income households.

- Who files: Head of household or authorized representative.

- Deadline to report changes: Within 10 days of knowing a change.

- Key attachments: SSNs for applicants, proof of disability payments, medical receipts over $35.

- Submit to: Texas HHSC (mail or fax addresses on the form).

- Interpreter support: Available at no cost via the provided phone lines.

- Witness needed: If main contact signs with an X, a witness signature is required.

- Penalty for fraud: May include fines, jail, disqualification, and repayment obligations.

- Can non-citizens apply for children? Yes — children who are U.S. citizens may be eligible even if an adult is not a citizen.

- Is online reporting possible? Yes — use YourTexasBenefits.com or the mobile app to report changes.

Related Forms and Resources (Navigation)

- SNAP Combined Application Project (SNAP-CAP) forms

- General SNAP application and recertification forms

- Medicaid and CHIP enrollment forms

- Texas voter registration form (co-located services)

- HHSC instructions and program integrity guidance

Final Notes and Form Details

This guidance is informational and intended to help you complete Form H0011-R accurately. It does not constitute legal advice. For case-specific questions or complex immigration concerns, consult a qualified advisor or the HHSC help lines listed on the form.

Form name: Texas Simplified Application Project (TSAP) — SNAP Renewal

Form number: H0011-R

Region/agency: Texas Health and Human Services Commission (HHSC)

Revision date: 10/2023