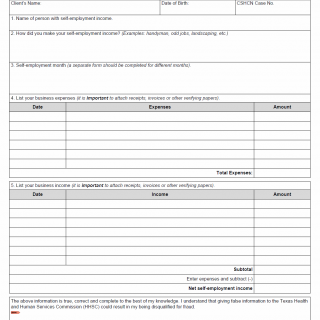

TX HHS Form 3063. CSHCN Statement of Self-Employment Income

The TX HHS Form 3063, CSHCN Statement of Self-Employment Income, is a crucial document for individuals with Children with Special Health Care Needs (CSHCN) who have self-employment income. This form helps solve the problem of accurately reporting self-employment income to ensure eligibility for relevant services and programs.

The form requires the individual with self-employment income to provide specific information, including their name, date of birth, CSHCN case number, and details about their business, such as how they made their income and what expenses were incurred. It is essential to attach receipts, invoices, or other verifying papers to support the reported income and expenses.

By completing this form, individuals with self-employment income can accurately report their income and ensure that they are eligible for necessary services and programs. Key points to note include:

- The form is used by individuals with CSHCN who have self-employment income.

- The individual must provide specific information about their business, including how they made their income and what expenses were incurred.

- It is crucial to attach verifying papers to support the reported income and expenses.