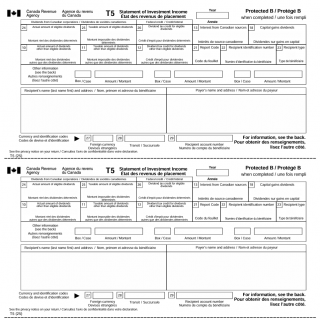

T5 Statement of Investment Income - CRA

The T5 Statement of Investment Income is a Canadian tax form used to report various types of investment income earned by individuals, corporations, trusts, and other entities during the tax year. This form ensures accurate reporting to the Canada Revenue Agency (CRA) and allows recipients to correctly include investment earnings on their income tax and benefit return.

Purpose of the Form

The primary purpose of the T5 slip is to summarize investment income such as interest, dividends, royalties, capital gains dividends, and annuities received from Canadian and foreign sources. It also reports foreign taxes paid and other income that may affect the recipient’s tax obligations. The information provided on the T5 allows the CRA to verify income reporting and calculate any applicable tax credits.

Who Uses This Form

-

Financial institutions, corporations, or other payers of investment income.

-

Individuals, joint account holders, trusts, corporations, or other entities receiving investment income.

Form Sections

-

Recipient Information – Name, address, and Social Insurance Number (SIN) or business number.

-

Payer Information – Name and address of the entity issuing the T5.

-

Income Boxes – Specific boxes for different types of income and credits:

-

Boxes 10, 11, 12, 24, 25, 26 – Dividends (eligible and non-eligible) from Canadian corporations.

-

Box 13 – Interest from Canadian sources.

-

Boxes 14–15 – Other income, including foreign income.

-

Box 16 – Foreign tax paid (used for foreign tax credit).

-

Box 17 – Royalties from Canadian sources.

-

Box 18 – Capital gains dividends.

-

Box 19 – Accrued income from annuities.

-

Box 30 – Equity linked notes interest.

-

Important Considerations

-

Multiple recipients: If an account is jointly held, the T5 should reflect all names with the primary SIN indicated and code “2” for joint accounts.

-

Trusts and corporations: Report investment income in the name of the entity, not individual beneficiaries.

-

Reporting requirements: Investment income must be included on the applicable lines of the recipient’s income tax return (e.g., interest to line 12100, dividends to lines 12000 and 40425).

-

Filing: T5 slips may be submitted on paper or electronically. Copies are sent to both the CRA and the recipient.

Benefits

-

Ensures compliance with Canadian tax law.

-

Provides recipients with accurate reporting of investment income for tax filing.

-

Supports calculation of tax credits such as the federal dividend tax credit or foreign tax credit.

Filing Tips

-

Complete the form accurately using information from the financial institution or payer.

-

Verify the SIN or business number of the recipient.

-

Keep copies for your records and provide the recipient with their copy promptly.

-

Refer to Guide T4015 – T5 Guide: Return of Investment Income for detailed instructions.

Use Cases

-

Annual reporting of interest earned on bank accounts, GICs, or savings bonds.

-

Reporting dividends received from Canadian corporations.

-

Documenting royalties, annuities, and capital gains dividends.

-

Reporting foreign investment income and taxes paid abroad.

In summary, the T5 Statement of Investment Income is a crucial document for both issuers and recipients of investment income, enabling accurate reporting, compliance with Canadian tax regulations, and proper calculation of related tax credits.