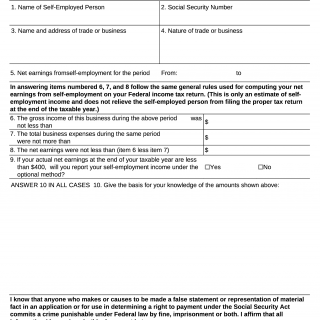

Form SSA-766. Statement of Self-Employment Income

Form SSA-766, the Statement of Self-Employment Income, serves as a declaration of self-employment income. The main purpose is to report earnings from self-employment, which helps the Social Security Administration (SSA) determine an individual's eligibility for various benefits and calculate their benefit amount accurately.

For example, if an individual is self-employed and needs to report their income for Social Security or Medicare tax purposes, they would use this form. The benefit is that it ensures the SSA has accurate information for benefit calculations.

The parties involved are self-employed individuals and the SSA. This form usually includes sections for reporting self-employment income, expenses, and other relevant financial details.