SBA Form 3508. PPP Loan Forgiveness Application

SBA Form 3508, also known as the PPP Loan Forgiveness Application, is a document used by borrowers who have received a Paycheck Protection Program (PPP) loan to apply for loan forgiveness. The form is used to calculate the amount of the loan that may be forgiven based on the borrower's use of the loan funds.

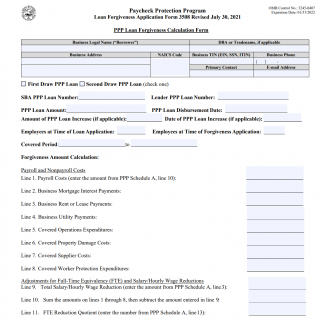

The form consists of several parts, including a PPP Loan Forgiveness Calculation Form, a PPP Schedule A, and a PPP Schedule A Worksheet. Important fields to consider when filling out the form include the borrower's payroll and non-payroll expenses during the covered period, the number of full-time equivalent employees, and any reductions in employee salaries or wages.

The parties involved in the form are the borrower and the lender who provided the PPP loan. When filling out the form, data such as the borrower's payroll expenses, rent or lease payments, and utility payments will be required. Additionally, the borrower may need to attach copies of relevant documents, such as payroll reports or rent receipts, to provide supporting documentation for the expenses listed.

Application examples and use cases for the PPP Loan Forgiveness Application include businesses that have received PPP loans and have used the funds to cover eligible expenses such as payroll, rent, and utilities. The form is used to apply for loan forgiveness and can help businesses avoid having to repay the loan.

Strengths of the form include its ability to provide a clear and structured process for calculating loan forgiveness, which can help borrowers accurately report their use of the loan funds. Weaknesses of the form include the potential for errors or omissions in the information provided, as well as the complexity of the calculations required to determine loan forgiveness amounts.

Alternative forms to the PPP Loan Forgiveness Application include the EZ version of the form, which is available to borrowers who meet certain criteria related to employee headcount and reductions in employee salaries or wages. Analogues to the form include loan forgiveness applications used in other government loan programs, such as the Economic Injury Disaster Loan (EIDL) program.

The PPP Loan Forgiveness Application can have a significant impact on the future of the participants, as loan forgiveness can help businesses avoid having to repay the loan and can provide much-needed financial relief. It is important to carefully review and accurately complete the form to maximize the amount of loan forgiveness and avoid potential complications or delays in the loan forgiveness process.

The form can be submitted to the borrower's PPP lender, who will review the application and make a determination on loan forgiveness. Once submitted, the form will be stored in the borrower's loan file and used by the lender to assess the borrower's eligibility for loan forgiveness.

Overall, the PPP Loan Forgiveness Application is an important form for small business owners who have received a PPP loan and are seeking loan forgiveness. It can provide relief for struggling businesses during these challenging times.

Notice: The Paycheck Protection Program (PPP) ended on May 31, 2021. Existing borrowers may be eligible for PPP loan forgiveness.