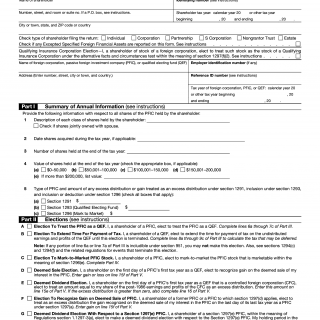

IRS Form 8621. Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund

IRS Form 8621 is an Information Return that must be filed by a shareholder of a Passive Foreign Investment Company (PFIC) or Qualified Electing Fund (QEF). The main purpose of this form is to report specific tax information about the foreign investment company and its shareholders to the Internal Revenue Service (IRS).

The form consists of several parts, including identifying information about the taxpayer and the foreign investment company, as well as details about the shareholder's income, deductions, and credits. Some important fields include the number of shares held, acquisition date, and cost basis.

It is important to consider several factors when filling out this form, such as the type of investment, the length of time the investment was held, and the taxpayer's overall tax situation. Taxpayers may need to consult with a tax professional to ensure they are accurately reporting all required information.

Data required when filling out the form may include financial statements, records of dividends received, and information on any foreign taxes paid. In addition, taxpayers may need to attach additional schedules or statements to provide more detailed information.

Examples of when this form might be required include investments in foreign mutual funds, hedge funds, or other investment vehicles. Failure to file Form 8621 can result in significant penalties, so it is important to ensure accurate and timely filing.

Strengths of this form include its ability to provide the IRS with important information about foreign investment companies and their shareholders, while weaknesses may include the complexity of the form and the potential for errors or omissions.

Alternative forms or analogues may include Forms 5471 or 8865, which are used to report information about foreign corporations or partnerships in which a U.S. person has ownership or control.

Filing Form 8621 can have future implications for the taxpayer, including potential taxes or penalties related to the investment. The form is typically submitted electronically through the IRS e-file system and should be stored for at least three years.

Overall, IRS Form 8621 is an important tool for reporting information about foreign investment companies and ensuring compliance with U.S. tax laws.