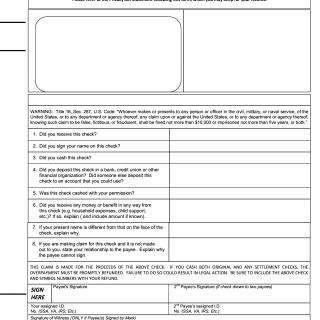

Claim Form FS1133 - Claim Against the United States for the Proceeds of a Government Check

Claim Form FS1133 is designed to facilitate the process of claiming the proceeds of a U.S. Treasury check issued by the United States government. This form is essential for individuals who need to rectify issues related to their government checks, such as cashing, depositing, or endorsing discrepancies.

The primary purpose of Claim Form FS1133 is to enable individuals to claim the proceeds of a U.S. Treasury check accurately and efficiently. This form guides claimants through a series of questions and instructions that help them provide essential information for resolving discrepancies, verifying check endorsements, and ensuring that the claimed funds are directed to the rightful payee.

Instructions:

1. Review Check Inquiry: If you are seeking to claim the proceeds of a U.S. Treasury check and believe there is an issue, initiate the process by carefully reviewing the details of the check inquiry.

2. Examine Check Endorsements: Thoroughly inspect the attached copy of the check, paying close attention to any handwritten or stamped endorsements on the back.

3. Confirm Check Details: Ensure that the date on the check copy matches the date of your missing check. If there are any discrepancies or concerns about the check amount, contact the relevant agency (e.g., Social Security Administration, Veterans Affairs, Internal Revenue Service) with sufficient information to locate the specific check.

4. Verify Check Deposits: If the check copy indicates that it was deposited into your financial institution, promptly verify with your bank, credit union, or savings and loan that your account was properly credited. If resolution is not achieved, proceed with completing Claim Form FS 1133 and including the check copy.

5. Decision to Proceed: If you authorized the check's cashing or have no intention of claiming the check amount, you are not required to submit the Claim Form.

6. Complete the Claim Form: Carefully answer all questions provided on both pages of the Claim Form. Part 1 pertains to the investigation and recovery process, while Part 2 focuses on criminal, administrative investigation, and handwriting analysis. It is essential to provide accurate and complete information.

7. Exceptional Situations: If you did not endorse the check, grant permission for its cashing, or derive any benefit from it, you must complete both pages of the Claim Form.

Form Completion Guidelines:

- Utilize black ink to fill out the Claim Form.

- Personally sign the form where indicated. In cases of dual payees, both parties must sign.

- A Witness signature is necessary only when a payee signs with a mark.

- Return the fully completed Claim Form, along with the check copy, to the designated address provided.

Return Address: U.S. Department of the Treasury Bureau of the Fiscal Service Claims Adjudication Section P. O. Box 51318 Philadelphia, PA 19115-6318

Retention: Retain your copy of the completed Claim Form for your records.

This form is designed to streamline the process of claiming government check proceeds, ensuring accuracy and resolution for individuals encountering discrepancies or issues with their U.S. Treasury checks.