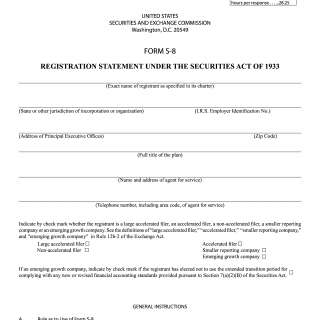

Form S-8. Registration Statement Under The Securities Act Of 1933

Form S-8 is a registration statement filed with the Securities and Exchange Commission (SEC) under the Securities Act of 1933. The purpose of the form is to register securities that will be offered to employees of a company or its affiliates as part of an employee benefit plan.

The form consists of several parts, including the basic information about the company, the securities being registered, and the employee benefit plan under which the securities will be offered. The form must be signed by the company's officers and directors, as well as any legal counsel involved in the offering.

The parties involved in the form are the company offering the securities and its employees who will be receiving the securities as part of an employee benefit plan. The SEC is also a party to the registration process.

Data required when filling out the form includes information about the company, the securities being registered, and the employee benefit plan under which the securities will be offered. Additionally, the form may require financial statements and other documentation related to the company's financial position and the offering of the securities.

Examples of when this form may be necessary include when a company wants to offer stock options or other securities to its employees as part of a compensation package. By filing Form S-8, the company can register the securities with the SEC and ensure compliance with securities laws.

Strengths of this form include providing a streamlined process for registering securities offered to employees and ensuring compliance with securities laws. Weaknesses may include the potential for errors or omissions in filling out the form, which could lead to non-compliance.

Alternative forms or analogues of this form include Form S-1 for registering securities for public sale and Form S-3 for registering securities for public sale by well-established companies. The main difference between these forms is the specific requirements and regulations of the SEC based on the type of offering being made.

The form affects the future of the participants by ensuring compliance with securities laws and providing employees with an opportunity to invest in the company. Failure to properly register the securities could result in regulatory action or legal consequences.

The form can be submitted to the SEC electronically through the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system. The form should be stored in the company's records for at least five years.