Credit Card Authorization Form

A credit card authorization form is a legal document that enables a third party to make a payment using a person's written consent and credit card information. Its primary purpose is to ensure that the payment is made by the authorized person and to avoid fraud or unauthorized charges.

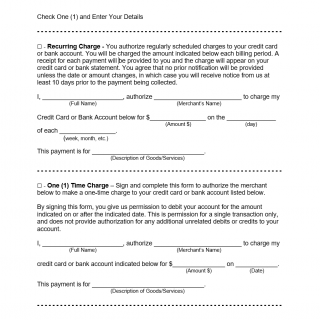

The form typically consists of several parts, including the cardholder's personal information, the credit card details, the payment amount, and the purpose of the payment. The important fields to consider when compiling the form are the cardholder's name, billing address, credit card number, expiration date, security code, and signature.

The parties involved in the form are the cardholder, the third party authorized to make the payment, and the merchant who receives the payment. It is important to consider the legal requirements and regulations when compiling the form, such as the need for the cardholder's signature, and the possibility of notarization depending on the state.

Documents that should be attached to the form include a copy of the cardholder's ID, a copy of the credit card used, and any relevant receipts or invoices. Application examples and use cases include gym memberships, Netflix subscriptions, and other recurring payments.

Strengths of the form include its ability to prevent fraud and unauthorized charges, while weaknesses include the potential for misuse of the credit card information. Opportunities and threats related to the form depend on the specific circumstances of each transaction.

Alternative forms and analogues include ACH authorization forms, direct debit authorization forms, and standing order forms. The main difference between these forms is the method of payment, with credit card authorization forms using credit cards, while ACH and direct debit forms use bank accounts.

The form affects the future of the participants by ensuring that payments are made accurately and legally, and by protecting against fraudulent activity. The form is typically submitted electronically or in paper format, depending on the merchant's preference, and is stored securely to protect the cardholder's information.

In conclusion, a credit card authorization form is a vital document that enables third-party payments while ensuring the cardholder's protection against fraud. It consists of several parts, important fields, and requires additional documents to be attached. The form is used for recurring payments and has strengths, weaknesses, opportunities, and threats. Alternative forms and analogues exist, and the form affects the future of participants by ensuring legal and accurate payments.