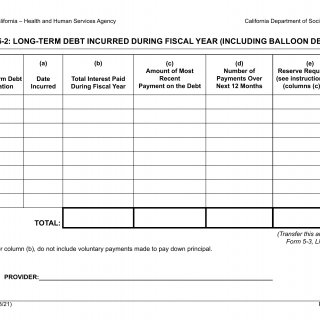

Form LIC 9266. Form 5-2: Long-Term Debt Incurred During Fiscal Year (Including Balloon Debt) - California

Form LIC 9266 is used in California by care facilities to report and provide details about long-term debt incurred during the fiscal year. This form is completed on an annual basis by the facility operator or administrator.

The form consists of sections that require information about the facility, including its name, address, license number, and the reporting period. The main part of the form focuses on documenting the details of long-term debt incurred during the fiscal year, including the creditor's name, original principal amount, interest rate, maturity date, and any relevant terms or conditions. The form also includes a section for reporting balloon debt, which refers to debt with structured repayment terms involving a large final payment.

An application example of this form would involve a care facility using Form LIC 9266 to report long-term debt incurred during the fiscal year to the California Department of Social Services. The facility operator or administrator would gather the necessary information about the outstanding debt, including loan agreements or contracts, and accurately fill out the form based on the provided instructions. By completing this form, care facilities provide important financial information to regulatory authorities and ensure compliance with reporting requirements.

Related forms: A related form is Form LIC 9265, Form 5-1: Long-Term Debt Incurred In A Prior Year (Including Balloon Debt) - California. While Form LIC 9266 focuses specifically on long-term debt incurred during the fiscal year, Form LIC 9265 is used for reporting long-term debt from a previous year. The main difference lies in the time frame covered by each form, with Form LIC 9266 focusing on the current fiscal year's debt, while Form LIC 9265 addresses debt incurred in a prior year.