Form LIC 9264. Form 1-2: Annual Provider Fee - California

Form LIC 9264 is used in California by care facilities to calculate and report the annual provider fee owed to the California Department of Social Services. This form is completed on an annual basis by the facility operator or administrator.

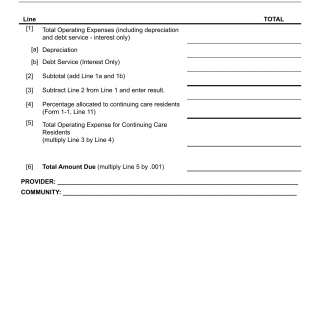

The form consists of sections that require information about the facility, including its name, address, license number, and the reporting period. The main part of the form focuses on calculating the annual provider fee based on facility-specific factors such as bed capacity, revenue, and expenses. Important fields include financial data related to the facility's operations, including gross revenue, allowable deductions, and applicable rates. The final section of the form is used to report the calculated annual provider fee payable to the Department of Social Services.

An application example of this form would involve a care facility using Form LIC 9264 to determine and report the annual provider fee. The facility operator or administrator would gather the necessary financial information, perform the calculations based on the provided instructions, and submit the form along with the payment to the Department of Social Services. By completing this form accurately, care facilities ensure compliance with fee requirements and contribute to the funding of regulatory oversight and support services.

Alternative forms: No direct alternative form is specified for Form LIC 9264, as it is specifically designated for calculating and reporting the annual provider fee. However, care facilities may need to consult other financial records and documentation related to their operations when completing this form.