Form ITD 3413. Small Estate Affidavit

Form ITD 3413 is used in Idaho in the event of a small estate where the total value of the decedent's assets does not exceed a certain threshold. The main purpose of this form is to simplify and expedite the process of transferring assets to the rightful beneficiaries without going through a formal probate proceeding.

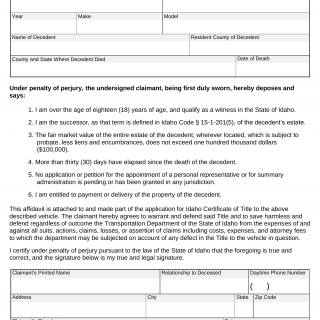

The form consists of sections where the affiant provides information about themselves, including their name, address, contact details, and relationship to the decedent. It also requires them to provide details about the decedent's assets, liabilities, and the proposed distribution of the estate.

When filling out the form, it is important to accurately provide all required information and ensure that the small estate meets the eligibility criteria specified by Idaho law. The affiant should carefully review the instructions on the form and consult with an attorney or legal professional if needed to ensure compliance with applicable laws.

An example application scenario would be when a person passes away with a small estate comprising personal belongings and modest financial accounts. By completing this form and submitting it to the appropriate authority, the affiant can facilitate the transfer of the decedent's assets to the designated beneficiaries without the need for a formal probate process, saving time and expenses associated with traditional probate proceedings.

Related forms: An alternative form closely related to this small estate affidavit is Form ITD 3414 - Affidavit of Collection of Personal Property. This form is used when the decedent's assets consist solely of personal property, such as bank accounts, vehicles, or personal belongings. The difference is that Form ITD 3413 is specifically designed for small estates where the total value of assets does not exceed a certain threshold, while Form ITD 3414 is used for the collection of personal property within the estate.