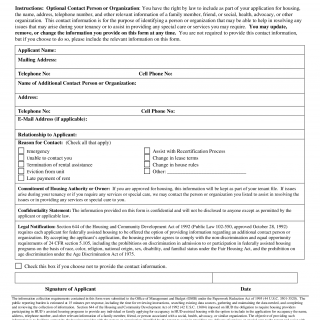

Form HUD-92006. Supplement To Application For Federally Assisted Housing

Form HUD-92006 is a supplement to the Application for Federally Assisted Housing, which is under the jurisdiction of the U.S. Department of Housing and Urban Development (HUD). This form is used to collect additional information about an individual's history, identity, and finances in order to determine their eligibility for federally assisted housing programs. The form consists of three parts: background information, income information, and assets information.

In the background information section of the form, applicants must provide their personal data such Social Security number, date of birth, and current address. They must also provide information about family members, such as their names, Social Security numbers, and dates of birth. This section also requires applicants to answer questions about their employment status, mobility and disabilities, family composition, and the size of their household.

The income information section requires applicants to provide evidence of their income, such as pay stubs, statement of Social Security benefits, and additional income sources. Applicants must also report any changes in income from the previous year.

Finally, the assets information section of the form requires applicants to provide a detailed list of all assets owned, including all real property, automobiles, stocks, bonds, and deposits. Applicants must also specify the dollar amount and source of each asset and include evidence of ownership for any assets valued at over $5,000.

The primary strength of the HUD-92006 form is that it provides a detailed record of an individual's background, income, and assets, which is useful for determining their eligibility for federally assisted housing programs. By providing this information, HUD is able to accurately identify individuals who are most in need of assistance, while also preventing fraud or illegitimacy by ensuring that applicants are qualified for the program.

The primary weakness of the HUD-92006 form is that it does not provide as much information about an applicant's employment or credit history as some other forms, such as Form HUD-50077: Application for Housing Assistance. This can make it difficult for HUD to properly assess the eligibility of some applicants.

In terms of opportunities and threats, the HUD-92006 form presents few disadvantages or risks. The primary advantage of using this form is that it enables HUD to quickly and accurately identify individuals who are eligible for federally assisted housing programs. However, there is a potential risk that the information provided on the form could be used in an unauthorized or unethical manner.

An alternative form that is similar to the HUD-92006 is the HUD-50077 Application for Housing Assistance. This form is used by applicants to apply for public housing assistance and requires applicants to provide information about their residence history, employment history, and credit history. The form also requires applicants to list any family members and to list their assets as well.

Overall, the HUD-92006 form is an important tool for determining an individual's eligibility for federally assisted housing programs. It is important for applicants to remember to fill out the form completely and accurately in order for HUD to make an accurate assessment of their eligibility. Applicants should also remember that the information they provide can be used in legal proceedings.