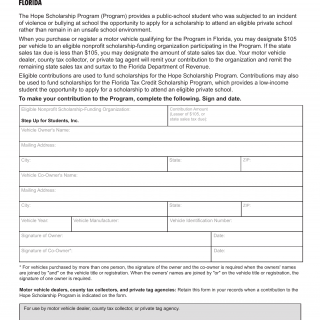

Form DR-HS1. Hope Scholarship Program Contribution Election Florida Department of Revenue form - Florida

The Form DR-HS1, also known as the Hope Scholarship Program Contribution Election form, is a document issued by the Florida Department of Revenue. This form is specifically designed for individuals or businesses who wish to contribute to the Hope Scholarship Program, which provides scholarships for students who have been victims of bullying or harassment in public schools.

The purpose of this form is to allow taxpayers to make voluntary contributions to the Hope Scholarship Program and designate the amount they want to contribute. The funds collected through this program are used to provide eligible students with scholarships to attend private schools or transfer to another public school that better meets their needs.

The form consists of several important fields that need to be filled out accurately. These fields include:

- Contributor's name and contact information

- Taxpayer identification number (Social Security Number or Employer Identification Number)

- Contribution amount

- Payment method (check or electronic payment)

- Date of contribution

When filling out this form, it is essential to double-check all the information provided to ensure accuracy. It is especially important to enter the correct taxpayer identification number to ensure proper attribution of the contribution.

No additional documents need to be attached when submitting this form. However, individuals or businesses may need to keep a record of the contribution for their own records and tax purposes.

An example of an application for this form would be a business owner who wants to support the Hope Scholarship Program by making a monetary contribution. By completing this form and submitting it to the Florida Department of Revenue, the business owner can contribute to the scholarship fund and help students who have experienced bullying or harassment.

There are no direct alternatives or analogues to this specific form, as it is unique to the Hope Scholarship Program in Florida. However, individuals or businesses interested in supporting education-related initiatives may explore other tax-deductible contribution programs or scholarship funds available at the state or national level.