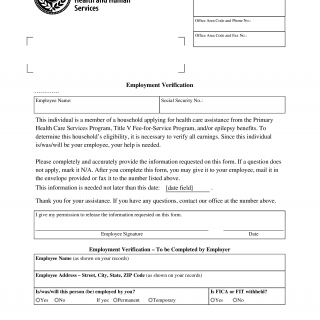

Form 3049 - Texas Employment Verification

Form 3049 is an employment verification document used in the context of health care assistance programs, specifically the Primary Health Care Services Program, Title V Fee-for-Service Program, and epilepsy benefits in the state of Texas. This form is employed to verify the earnings of an individual who is a member of a household applying for health care assistance benefits. It is designed to ensure that accurate financial information is provided to determine the household's eligibility for these assistance programs.

Purpose:

The purpose of Form 3049 is to collect employment and income-related information from an individual's employer. This information is crucial for verifying the earnings and employment status of an individual who is part of a household applying for health care assistance benefits in Texas. Accurate employment and income data is essential for assessing the eligibility of the household for the specified health care assistance programs.

Usage Case:

Form 3049 is used in the following context:

- Health Care Assistance Application: This form is used when a household applies for health care assistance from programs like the Primary Health Care Services Program, Title V Fee-for-Service Program, or epilepsy benefits. To determine eligibility, the household must provide accurate information about their earnings, which includes information about individuals employed by specific companies or employers.

Structure:

Form 3049 is structured with specific sections to collect employment and income-related data. The key sections of the form include:

-

Office Information: This section specifies the office address, area code, fax number, case record number, and area code and phone number for further correspondence.

-

Employee Information: This section captures information about the employee whose earnings are being verified, including their name and social security number.

-

Permission for Release: The employee is asked to provide their signature and the date, granting permission to release the requested information.

-

Employment Verification (To be Completed by Employer): This section is to be completed by the employer and includes details such as the employee's name, address, employment status (permanent/temporary), and whether FICA or FIT (Federal Insurance Contributions Act or Federal Income Tax) is withheld.

-

Rate of Pay: Employers are required to provide information about the employee's rate of pay and how often they are paid (hourly, daily, weekly, etc.).

-

Income Details: Employers must list all wages received by the employee during specific months. The chart includes fields for the date pay period ended, date the employee received pay, actual hours worked, gross pay, and other pay (bonuses, commissions, overtime, etc.). There's also a comments section to explain how other pay is received.

-

Employee Details: Employers should provide information about the employee's date of hire, date of the first paycheck received, and details if the employee is/was on leave without pay.

-

Final Employment Information: If the employee is no longer employed by the company, details about the date of the final paycheck received and the gross amount of that paycheck are required.

-

Health Insurance Information: Employers are asked to provide information about the availability of health insurance to the employee. This includes whether health insurance is available, whether the employee is enrolled for self-only or with family members, and any additional comments.

-

Employer Information: The form concludes with sections to provide details about the company or employer, including their name, address, area code, phone number, the name of the person verifying the information, and their title.

Form 3049 is comprehensive and structured to ensure that all the necessary information regarding employment and earnings is accurately collected and verified for health care assistance program eligibility. It serves as a crucial document in the application process.