FinCEN Form 105 - Report of International Transportation of Currency or Monetary Instruments

FinCEN Form 105, also known as the "Report of International Transportation of Currency or Monetary Instruments," is an official document required by the United States Department of the Treasury's Financial Crimes Enforcement Network (FinCEN). This form serves as a crucial tool in combating financial crimes and money laundering. It must be filed with the Bureau of Customs and Border Protection (CBP) under the guidelines set forth in 31 U.S.C. 5316 and 31 CFR Chapter X.

Purpose and Applicability: The primary purpose of FinCEN Form 105 is to monitor and regulate the cross-border movement of currency and other monetary instruments. It is applicable in the following scenarios:

- Individuals who physically transport, mail, or ship currency or monetary instruments exceeding $10,000 in aggregate value from the United States to any foreign destination or into the United States from abroad.

- Individuals who receive currency or monetary instruments exceeding $10,000 in aggregate value in the United States, which have been transported, mailed, or shipped from a foreign location.

Exceptions: There are specific exemptions from filing this report, including transactions involving Federal Reserve banks, certain financial institutions, and common carriers, among others.

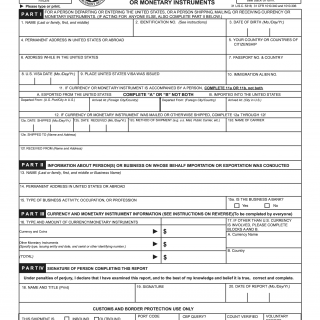

Key Sections and Information: The FinCEN Form 105 consists of several parts, each designed to collect essential information:

-

Part I: Information about the person transporting or receiving the currency or monetary instruments.

- Identification details.

- Permanent address in the United States or abroad.

- Country or countries of citizenship.

- Immigration alien number.

- U.S. Visa details.

-

Part II: Information about the person or business on whose behalf the importation or exportation was conducted.

- Name and complete address.

-

Part III: Currency and monetary instrument information.

- Type and amount of currency and coins.

- Details of other monetary instruments, including type, issuing entity, date, and serial or identifying numbers.

-

Part IV: Signature and date of the person completing the report.

Where and When to File: The filing instructions vary depending on whether you are a recipient, shipper/mailer, or traveler. The form must be filed within specific time frames, typically within 15 days of receipt or on the date of entry, departure, mailing, or shipping.

Penalties: Failure to file this report, filing an incomplete or false report, or omitting material information can result in severe civil and criminal penalties, including fines and imprisonment. Currency or monetary instruments involved may also be subject to seizure and forfeiture.

Privacy and Information Collection: The collection of information on FinCEN Form 105 is authorized by various statutes and regulations, including the Privacy Act of 1974. The information collected may be shared with relevant government agencies for the purpose of criminal investigations and regulatory enforcement.

Paperwork Reduction Act Notice: The form includes a notice that outlines the estimated burden associated with completing the form and provides information on how to comment on the accuracy of this burden estimate.

FinCEN Form 105 plays a vital role in safeguarding the financial integrity of the United States by helping authorities track the movement of large sums of currency and monetary instruments across international borders. Compliance with its reporting requirements is essential to avoid legal consequences.