Direct Deposit Authorization Form

A direct deposit authorization form is a legal document that authorizes an employer to deposit an employee's paycheck directly into their bank account. The main purpose of this form is to simplify the payment process for both the employer and the employee.

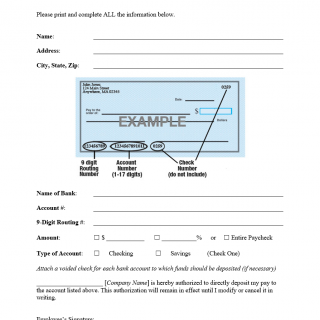

The form consists of several parts, including the employee's personal information, such as name, address, and social security number. The important fields of the form include the employee's bank account number and routing number, as well as the type of account, whether it's a checking or savings account.

The parties involved in this form are the employee, employer, and the bank. It's important to consider the accuracy of the information provided on the form when compiling it, as any mistakes can cause delays in payment or even result in the payment being sent to the wrong account.

When compiling the form, the employee will need to provide their personal and bank account information. They may also need to attach a voided check to the form, as this will provide the necessary bank account information.

Examples of applications of this form include payroll processing and government benefits payments. Practice and use cases include the convenience of having funds deposited directly into the employee's bank account. The benefits of using this form include saving time and reducing the risk of lost or stolen checks. However, the risks associated with this form include the possibility of incorrect information being entered, which can result in delayed or missed payments.

Related forms include a paper check request form, while alternative forms may include electronic payment methods such as PayPal or Venmo. The main difference between these forms is the method of payment.

The direct deposit authorization form affects the future of the participants by providing a convenient and secure method of payment, which can help to improve financial management. The form is typically submitted to the employer's human resources department and stored securely in the employer's records.

In conclusion, a direct deposit authorization form is a useful legal document that simplifies the payment process for both employees and employers. By providing accurate and up-to-date information, employees can benefit from timely and secure payments, while employers can save time and reduce the risk of errors.