GA DMV Form MV-7DW State and Local Title Ad Valorem Tax (TAVT) Fees for ETR Remote E-signature Solutions

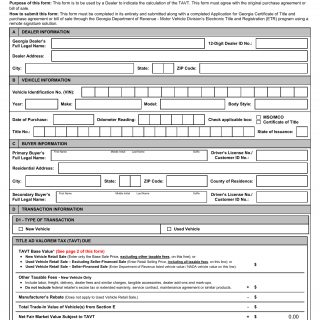

Form MV-7DW serves as a document for calculating State and Local Title Ad Valorem Tax (TAVT) fees for electronic title and registration (ETR) transactions with remote electronic signatures.

This form is used to determine the TAVT fees for ETR transactions conducted with remote electronic signatures, ensuring that the correct tax amount is assessed for vehicle purchases or transfers.

Form Structure

This form involves the vehicle purchaser or transferee, the seller, and the Georgia Department of Driver Services. It typically consists of sections for providing transaction details, calculating TAVT fees, and documenting the transaction.

The important fields on this form include transaction details, vehicle information, and calculations for TAVT fees.

How to Fill Out and Submit the Form

The form is typically completed by the seller or the entity responsible for collecting the TAVT fees. It requires accurate transaction information and calculations for TAVT fees. The completed form is submitted as part of the ETR transaction.

It's important to ensure that the TAVT fees are calculated correctly to avoid any discrepancies in the transaction.

Form MV-7DW is essential for conducting ETR transactions with remote electronic signatures and calculating TAVT fees accurately. There are no direct alternatives for this form.