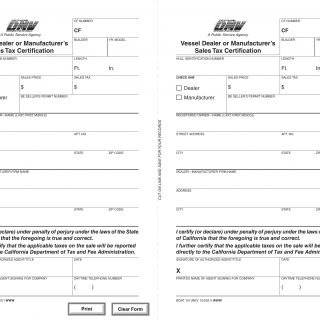

CA DMV Form Boat 110. Vessel Dealer or Manufacturer's Sales Tax Certification

The CA DMV Form Boat 110, also known as the Vessel Dealer or Manufacturer's Sales Tax Certification, is used by vessel dealers or manufacturers in California to certify the sales tax status of a vessel. The form consists of several sections that require specific information to be filled out accurately.

Important fields on this form include:

- Dealer or manufacturer information: This section requires the dealer or manufacturer's name, address, and contact details.

- Vessel information: This section requires details about the vessel being sold, such as the make, model, year, hull identification number (HIN), and purchase price.

- Sales tax information: This section requires the dealer or manufacturer to indicate whether sales tax has been paid or is exempt for the vessel.

- Signature and date: The form must be signed and dated by an authorized representative of the dealer or manufacturer.

Parties involved in this form are the vessel dealer or manufacturer and the California Department of Motor Vehicles.

When filling out this form, it is important to ensure accurate and complete information is provided. Any errors or omissions may result in delays or complications in the sales tax certification process. It is recommended to double-check all information before submitting the form.

An application example for this form would be when a vessel dealer sells a new boat to a customer in California. The dealer would need to complete this form to certify the sales tax status of the vessel and provide it to the customer as proof of compliance with tax regulations.

An alternative form that may be related to this is the CA DMV Form REG 31, which is used for vehicle/vessel transfer and reassignment. While both forms involve the transfer of ownership, the CA DMV Form Boat 110 specifically focuses on the sales tax certification aspect for vessels.