Durable Power of Attorney for Finances

A durable power of attorney for finances is a simple, inexpensive, and reliable way to arrange for someone to make your financial decisions should you become unable to do so yourself. It’s also a wonderful thing to do for your family members. If you do become incapacitated, the durable power of attorney will likely appear as a minor miracle to those close to you.

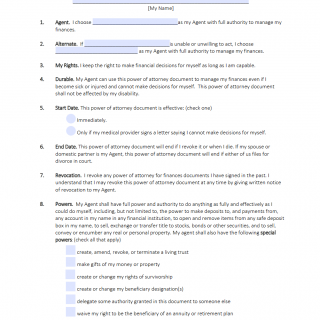

When you create and sign a power of attorney, you give another person legal authority to act on your behalf. This person is called your attorney-in-fact or, sometimes, your agent. The word "attorney" here means anyone authorized to act on another's behalf; its most definitely not restricted to lawyers.

A "durable" power or attorney stays valid even if you become unable to handle your own affairs (incapacitated). If you don't specify that you want your power of attorney to be durable, it will automatically end if you later become incapacitated.

There arc two kinds of durable powers of attorney for finances: those that take effect immediately and those that don't take effect unless and until a doctor (or two, in some states) declares that you can no longer manage your financial affairs. Which kind you should make depends, in part, on when you want your attorney-in-fact to start handling tasks for you.

If you want someone to take over some or all of your affairs now, you should make your document effective as soon as you sign it. Then, your attorney-in-fact can begin helping you with your financial tasks right away - and can continue to do so if you later become incapacitated.