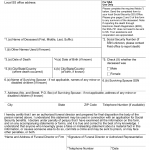

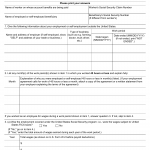

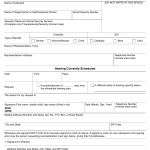

Form SSA-769-U4. Request for Change in Time/Place of Disability Hearing

Form SSA-769-U4, the Request for Change in Time/Place of Disability Hearing, is used to request changes to the time or place of a scheduled disability hearing. The primary purpose is to allow individuals to request adjustments to their hearing arrangements when necessary.

An example scenario is when a claimant scheduled for a disability hearing needs to change the time or location due to unforeseen circumstances. The benefit is that it offers flexibility in accommodating the needs of the claimant.