Form FT 462. Fuels Tax Bond - Virginia

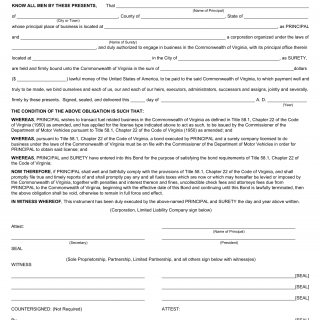

Form FT 462. Fuels Tax Bond is used by customers to submit a collateral bond in lieu of a certificate of deposit to the Virginia Department of Motor Vehicles (DMV). The main purpose of this form is to provide an alternative method for customers to fulfill their financial responsibility requirements for the fuels tax without placing a certificate of deposit.

The parties involved in this form are the customers submitting the collateral bond and the Virginia Department of Motor Vehicles (DMV). The form consists of sections where the customer provides information about the type and value of the collateral bond being submitted.

Important fields in this form include the customer's name, contact information, details of the collateral bond, and the purpose of the submission (i.e., to fulfill fuels tax financial responsibility). The form may also require an explanation of the reason for choosing a collateral bond over a certificate of deposit.

An example scenario where this form would be used is when a business owner with a fleet of vehicles needs to demonstrate financial responsibility for the fuels tax but prefers to submit a collateral bond instead of a certificate of deposit. By using this form, the owner can provide the necessary financial assurance to the DMV without tying up a significant amount of funds in a certificate of deposit.

When filling out this form, the customer must accurately provide details of the collateral bond and ensure compliance with the DMV's requirements for the submitted bond. The customer should also retain evidence of the bond submission for their records.

No specific additional documents are mentioned for this form. Related forms could include other forms used to provide financial responsibility proof to the DMV. An alternative could be obtaining a certificate of deposit from a financial institution instead of submitting a collateral bond.