IRS Form 13909. Tax-Exempt Organization Complaint (Referral) Form

IRS Form 13909, also known as the Tax-Exempt Organization Complaint (Referral) Form, is a crucial document used for reporting complaints or referring concerns related to tax-exempt organizations. It serves as a means for individuals or organizations to notify the Internal Revenue Service (IRS) about suspected violations or potential misconduct by tax-exempt entities.

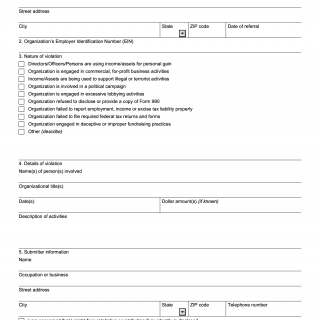

The form consists of several important fields that must be completed accurately to facilitate effective investigation and resolution. These include providing information about the complainant, such as their name, address, and contact details. Additionally, details about the organization being reported, including its name, address, and alleged violations, must be provided.

When filling out Form 13909, it is crucial to ensure that all required data is included. This includes specific dates, amounts, or any supporting evidence that can substantiate the complaint. To strengthen the case, attaching additional documents, such as contracts, financial statements, or correspondence, can provide valuable context and evidence.

This form is essential for anyone who suspects fraudulent activities, non-compliance with tax laws, or other issues involving tax-exempt organizations. For instance, concerned citizens, employees, competitors, or individuals with knowledge of irregularities can utilize this form to report their observations and help maintain the integrity of the tax-exempt sector.

While there are no direct alternatives to IRS Form 13909, related forms exist for reporting other types of tax-related concerns. For example, Form 3949-A is used to report suspected tax fraud in general, while Form 14157 is specifically designed for reporting abusive tax promotions or schemes.

Once completed, Form 13909 can be submitted to the IRS through various means, including mail or fax. It is crucial to retain a copy of the form for personal records, as submissions are not acknowledged by the IRS unless further action is taken based on the complaint.

The IRS stores and processes the submitted Form 13909 in a secure and confidential manner. The information provided is used by the appropriate IRS departments to investigate reported concerns and take necessary actions to ensure compliance with tax laws and regulations.

Overall, IRS Form 13909 is a vital tool for reporting complaints and referring potential misconduct by tax-exempt organizations. By facilitating this reporting process, the form helps maintain the integrity of the tax-exempt sector and ensures fair and transparent operations within these organizations.