CBP Form 400. ACH Application

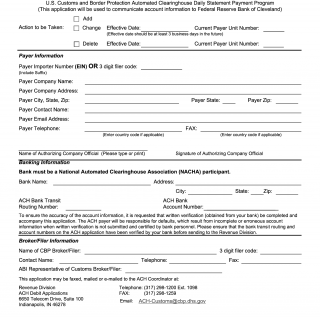

CBP Form 400, also known as the ACH Application, is a form required by the U.S. Customs and Border Protection (CBP) for businesses that wish to pay duties, taxes, and fees electronically. The main purpose of the form is to set up an Automated Clearing House (ACH) account with the CBP, which allows businesses to make electronic payments for their imports and exports.

The form consists of several parts, including information about the business, bank account details, and authorization for the ACH account. It is important for businesses to carefully consider the information they provide on the form, as any inaccuracies or omissions could result in delays or errors in their payments.

In addition to the completed form, businesses will need to submit supporting documents such as a voided check or bank letter to verify their account information.

One strength of the form is that it allows businesses to make electronic payments quickly and efficiently, reducing the risk of errors or delays associated with manual payment methods. However, a weakness is that it can be complex and time-consuming to complete, especially for businesses that are unfamiliar with ACH payments.

An example of a related form is the CBP Form 5291 Importer Security Filing and Additional Carrier Requirements, which is required for businesses importing goods into the United States. The main difference between the two forms is that the ACH Application is specifically focused on setting up electronic payments for duties, taxes, and fees, while the Importer Security Filing form is focused on providing information about the imported goods.

The completion of the form is crucial for the future of the participants, as it allows businesses to make electronic payments for their imports and exports, reducing the risk of errors or delays. The completed form should be submitted to the CBP via mail or email, and will be stored in the business's ACH account for future reference.