Proof of Funds Letter

A proof of funds letter is a document that demonstrates an individual or organization's financial ability to undertake a specific transaction or project. It is commonly used in real estate transactions, visa applications, and other financial transactions where proof of financial stability is required.

The letter typically consists of a statement from a bank or financial institution verifying the account holder's balance and the authenticity of the account. It may also include information on the account holder's credit history, assets, and liabilities.

Important fields to consider when compiling a proof of funds letter include the account holder's name, account number, and the purpose of the letter. The letter must be issued by a reputable financial institution and signed by an authorized representative.

When filling out the letter, applicants will need to provide identification documents, such as a passport or driver's license, and proof of ownership of the account. Additional documents may be required depending on the purpose of the letter.

Examples of practice and use cases for a proof of funds letter include real estate transactions where buyers must demonstrate their financial ability to purchase a property and visa applications where individuals must demonstrate their financial ability to support themselves while in a foreign country.

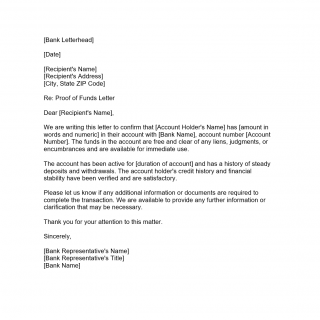

Sample of Proof of Funds Letter

[Bank Letterhead]

[Date]

[Recipient's Name]

[Recipient's Address]

[City, State ZIP Code]Re: Proof of Funds Letter

Dear [Recipient's Name],

We are writing this letter to confirm that [Account Holder's Name] has [amount in words and numeric] in their account with [Bank Name], account number [Account Number]. The funds in the account are free and clear of any liens, judgments, or encumbrances and are available for immediate use.

The account has been active for [duration of account] and has a history of steady deposits and withdrawals. The account holder's credit history and financial stability have been verified and are satisfactory.

Please let us know if any additional information or documents are required to complete the transaction. We are available to provide any further information or clarification that may be necessary.

Thank you for your attention to this matter.

Sincerely,

[Bank Representative's Name]

[Bank Representative's Title]

[Bank Name]

Strengths of the letter include its ability to provide proof of financial stability and increase the likelihood of a successful transaction or application. However, weaknesses include the potential for fraud or misrepresentation of financial status.

Alternative forms and analogues may include bank statements, certified public accountant (CPA) letters, and letters of credit. These documents may differ in the level of detail provided and the requirements for issuing them.

Overall, a proof of funds letter is an important document that can impact the outcome of a financial transaction or application. It should be compiled with care and attention to detail and submitted to the appropriate party for review and approval. The letter is typically stored as part of the transaction or application records.