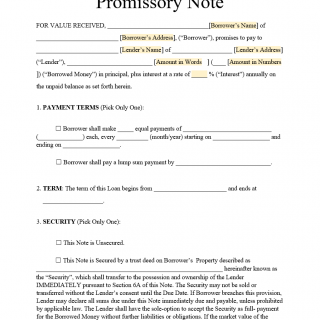

Promissory Note

A promissory note is a legal document that serves as a written promise to repay a debt or loan. It outlines the terms of payment, including the amount borrowed, interest rate, payment schedule, and consequences for non-payment.

The form typically consists of three main parts: the body, which outlines the terms of the loan, the signature block, where the borrower and lender sign the form, and a notary block, where a notary public can legally verify the signatures.

Promissory notes are commonly used in various scenarios, such as personal loans, business loans, and real estate transactions. They can be tailored to the specific needs of the borrower and lender, and may include additional clauses or provisions.

When filling out the form, the borrower and lender will need to provide personal information, such as their names and addresses, as well as the loan details, such as the loan amount, interest rate, and payment schedule. It is important to carefully review the terms of the note before signing, as it is a legally binding document.

The benefits of a promissory note include clear terms of repayment and legal recourse in case of non-payment. However, there are also potential risks and challenges, such as default on the loan, dispute over the terms of repayment, or damage to credit scores.

There are several related forms and alternatives to a promissory note, such as a loan agreement and convertible promissory note. In comparison to a loan agreement, a promissory note is a simpler legal document that only outlines the terms of payment. A convertible promissory note is used in startups and can be converted into equity in the company.

The completed promissory note is usually stored by both parties as proof of the loan agreement. It can be submitted to a notary public for legal verification, and may also be filed with the court in case of legal action.