Probate Power of Attorney

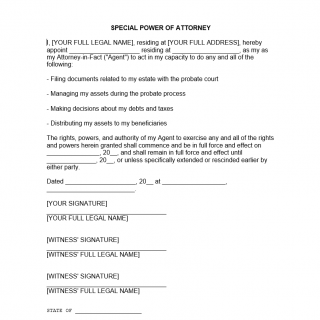

A Probate Power of Attorney is a legal document that grants an individual the power to act on behalf of an estate during the probate process. The document consists of several parts.

First, the document identifies the parties involved, including the individual granting power of attorney, the agent or attorney-in-fact, and the estate subject to probate. It also specifies the powers granted to the agent, which may include the ability to sell property, pay bills, and deal with other financial and administrative matters related to the estate.

The document also outlines any limitations or restrictions on the agent's powers, such as a specific time period or a requirement for authorization from the executor of the estate. The agent must agree to abide by these limitations or restrictions.

The Probate Power of Attorney may be drawn up in cases where the personal representative of the estate is unable or unwilling to carry out their duties, or in situations where the individual granting power of attorney is facing illness or incapacity and wants to ensure that their affairs are managed appropriately during the probate process.

The parties involved in the document are the individual granting power of attorney, the agent authorized to act on their behalf, and the estate subject to probate.

When compiling the Probate Power of Attorney, it is essential to ensure that the document accurately identifies the individual granting power of attorney and the estate subject to probate, authorizes the appropriate scope of power, and includes any necessary limitations or restrictions. It is also critical to ensure that the document complies with probate laws and regulations in the relevant jurisdiction.

The advantages of this form include giving the estate flexibility and the ability to respond to any necessary circumstances during the probate process. Additionally, it can be an effective way to delegate power within the estate and ensure that the affairs of the estate are handled appropriately.

However, any error or ambiguity in the document could lead to confusion, disputes, or legal challenges, especially if it does not comply with probate laws and regulations. It is always the best option to consult with an attorney experienced in probate law to ensure that the document is appropriately prepared and meets all legal requirements.