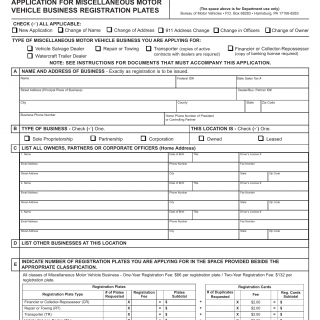

PA DMV Form MV-359. Application for Miscellaneous Motor Vehicle Business Registration Plates

Form MV-359 is an application form used for obtaining miscellaneous motor vehicle business registration plates in Pennsylvania. This form is utilized by businesses or individuals engaged in specific motor vehicle-related activities, such as dealerships, manufacturers, and repair shops, to register their vehicles for business purposes. The purpose of this form to ensure that motor vehicles used for business activities are properly registered and comply with state regulations.

The form consists of sections where applicants are required to provide their business information, including the business name, address, contact details, and tax identification number. Additionally, applicants must provide vehicle details, such as the make, model, year, and vehicle identification number (VIN), for each vehicle they intend to register for business purposes. The form also includes a section for indicating the type business activity being conducted.

Important fields in this form include accurate business information, vehicle details, and the correct indication of the type of business activity. It is essential to provide complete and accurate information to ensure proper registration the vehicles and compliance with state regulations. Failure to accurately complete the form may result in registration issues or penalties.

Application Example: A car dealership in Pennsylvania intends to register several vehicles for business purposes. To do so, they would need to complete Form MV-359. They would fill out their business information, provide the necessary vehicle details for each vehicle they wish to register, and indicate the type business activity being conducted. Once the form is completed, it should be submitted to the Pennsylvania Department of Transportation along with any required fees. By using this form, the dealership can ensure that their business vehicles are properly registered and compliant with state regulations.

Related Forms: There are no specific related forms mentioned for this particular transaction. However, businesses may need to provide additional documents such as proof of business registration, tax identification numbers, or supporting documentation related to their specific business activity.