New Health Insurance Marketplace Coverage Options and Your Health Coverage. OMB 1210-0149

The "New Health Insurance Marketplace Coverage Options and Your Health Coverage" form provides essential information to individuals about the Health Insurance Marketplace and its implications for their health coverage. The form is designed to help individuals make informed decisions regarding their health insurance options, particularly in light of the changes brought about by the Affordable Care Act in 2014.

Key Information in PART A:

-

Introduction to the Health Insurance Marketplace: The form begins by explaining that there will be a new way to purchase health insurance through the Health Insurance Marketplace starting in 2014. It emphasizes the importance of this change for individuals and their families.

-

Purpose of the Marketplace: It describes the Health Insurance Marketplace as a platform designed to help individuals find health insurance plans that align with their needs and budget. It highlights the convenience of "one-stop shopping" and mentions the availability of tax credits to lower monthly premiums.

-

Open Enrollment Period: The form mentions the open enrollment period, which typically starts in October for coverage beginning in January of the following year. It encourages individuals to explore their options during this period.

-

Premium Savings: It explains that individuals may be eligible to save on their health insurance premiums, based on their household income, but only if their employer does not offer coverage or if the offered coverage does not meet certain standards.

-

Employer Health Coverage Impact: The form clarifies that having access to employer-provided health coverage may affect an individual's eligibility for premium savings through the Marketplace. It encourages individuals to enroll in their employer's plan if it meets the required standards.

-

Cost Considerations: It outlines the circumstances in which an individual may be eligible for a tax credit, such as when the employer's coverage is unaffordable or does not meet the minimum value standard set by the Affordable Care Act.

-

Note on Tax Implications: The form advises individuals that if they choose Marketplace coverage over their employer's offering, they may lose any employer contributions to the plan. It also highlights that contributions to employer-offered coverage are often excluded from income for tax purposes.

-

Information Sources: The form provides information on where individuals can get more details about their employer's coverage and directs them to visit HealthCare.gov for comprehensive information, including an online application for health insurance coverage.

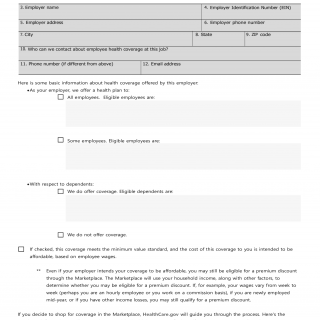

PART B: Information About Health Coverage Offered by Your Employer

In this section, the form collects specific details about the health coverage offered by the individual's employer. It provides a numbered list of information, including the employer's name, identification number, address, phone number, contact person, and email address. It also offers an overview of the coverage options available through the employer, whether it extends to all employees or only some, and whether it covers dependents.

Additionally, it mentions that the coverage meets the minimum value standard and is intended to be affordable based on employee wages. It emphasizes that even if coverage is considered affordable by the employer, individuals may still be eligible for premium discounts through the Marketplace based on their household income and other factors.

In conclusion, this form serves as a valuable resource for individuals to understand their health insurance options, including the Health Insurance Marketplace and the impact of their employer's coverage on their eligibility for premium savings. It provides clear guidance on where to obtain more information and how to navigate the enrollment process.