IRS Form 2159. Payroll Deduction Agreement

IRS Form 2159, Payroll Deduction Agreement, is a document used to authorize payroll deductions for payment of taxes owed to the Internal Revenue Service (IRS). The primary purpose of the form is to establish an agreement between taxpayers and the IRS for the repayment of delinquent taxes through automatic payroll deductions.

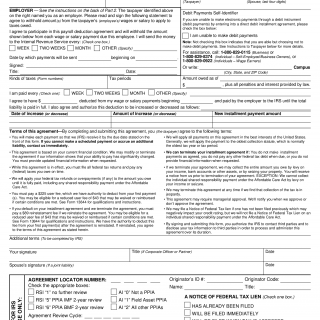

The IRS Form 2159 consists of several parts, including sections for identifying taxpayer information, employer information, tax period, and payment details. Important fields on the form include the taxpayer's name, social security number, employer identification number, total tax amount owed, payment frequency, and the signature of both the taxpayer and employer.

The parties involved in completing the IRS Form 2159 include taxpayers who owe delinquent taxes and their employers who agree to withhold the amounts from the employee's paychecks.

When filling out the IRS Form 2159, it is important to ensure that all required fields are completed accurately and completely. Data required for the form includes taxpayer and employer information, tax period, and payment details. Supporting documents such as payment vouchers or notices from the IRS may be required to verify the accuracy of the information provided on the form.

Examples of when the IRS Form 2159 may be required include when taxpayers owe back taxes to the IRS and are unable to pay the full amount owed at once. The form allows taxpayers to establish an agreement with the IRS to make regular payments through automatic payroll deductions.

Strengths of the IRS Form 2159 include its ability to help taxpayers repay delinquent taxes in a structured and manageable way, while weaknesses may include the potential for errors or inaccuracies if the form is not completed properly. Opportunities for improvement may include the use of digital forms or automated systems for processing payroll deductions.

Alternative forms or analogues to the IRS Form 2159 may include other IRS payment agreement forms, such as the Installment Agreement Request or Offer in Compromise forms, which offer alternative options for repaying delinquent taxes.

Completion and submission of the IRS Form 2159 may vary depending on the specific requirements of the taxpayer's employer and the IRS. In some cases, the form may be submitted electronically, while in other cases it may need to be physically signed and submitted by mail. The form is typically stored securely by the employer and/or the IRS.

Overall, the IRS Form 2159 plays an important role in helping taxpayers repay delinquent taxes through automatic payroll deductions. It establishes a structured payment plan that benefits both the taxpayer and the IRS.