Form 14-317. Affidavit of Motor Vehicle Gift Transfer - Texas

The Form 14-317, also known as the Affidavit of Motor Vehicle Gift Transfer, is a document used in the state of Texas to transfer ownership of a motor vehicle between family members as a gift. The purpose of this form is to provide proof of the gift transfer and to ensure proper documentation for the Department of Motor Vehicles (DMV).

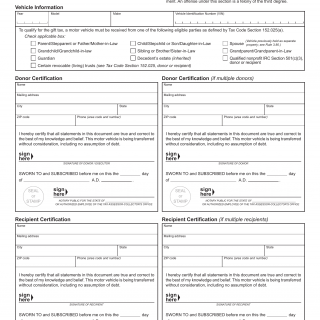

The form consists of several important fields that need to be completed accurately. These include information about the transferor (the person gifting the vehicle) and the transferee (the person receiving the vehicle). Key details required on the form include the vehicle identification number (VIN), make, model, year, license plate number, and odometer reading at the time of the transfer.

When filling out the Form 14-317, it is crucial to consider the following points:

- The form must be notarized by a licensed notary public.

- Both the transferor and the transferee must sign the form.

- The form should be submitted to the local county tax office along with any applicable fees and supporting documents.

Examples of situations where Form 14-317 may be used include transferring a vehicle as a gift between family members, such as parents gifting a car to their child. This form helps establish a legal record of the transaction and ensures compliance with state regulations.

An alternative form that serves a similar purpose is Form VTR-34, the Application for a Certified Copy of Title. While Form VTR-34 is primarily used to request a duplicate title, it can also be utilized for gift transfers if the original title is unavailable. The main difference between these forms is the specific purpose they serve, with Form 14-317 focusing exclusively on gift transfers.