Form VTR-125. Motor Vehicle Appraisal for Tax Collector Hearing / Bonded Title - Texas

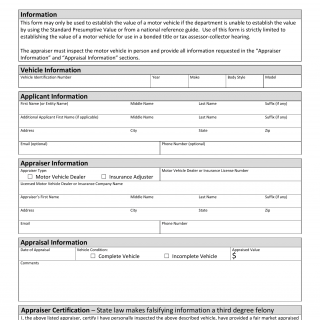

The Form VTR-125 is used in Texas for motor vehicle appraisal when applying for a tax collector hearing or a bonded title. This form is typically utilized when there is a lack of proper documentation or ownership evidence for a vehicle, and a tax collector hearing or bonded title process is required to establish legal ownership.

The appraisal form consists of sections that require accurate completion, including details about the vehicle, information about the person conducting the appraisal, the appraised value, and any additional notes or documentation related to the appraisal.

When filling out Form VTR-125, it is important to:

- Provide accurate information about the vehicle, including the make, model, year, and identification number.

- Include thorough details about the condition of the vehicle, any damages, or relevant factors affecting its value.

- Specify the appraised value of the vehicle based on market research or expert opinion.

- Ensure that the appraiser provides their name, contact information, and qualifications for conducting the appraisal.

This form is necessary when there is a need to establish the value of a vehicle for the purpose of a tax collector hearing or obtaining a bonded title. It helps determine the appropriate compensation or bonding requirements based on the appraised value and provides documentation to support the legal ownership of the vehicle.

An alternative form may be the Application for Duplicate Title, which is used when a vehicle's title is lost or missing. The Form VTR-125, however, specifically focuses on the motor vehicle appraisal process required for tax collector hearings or bonded titles.