Form LIC 420. Budget Information - California

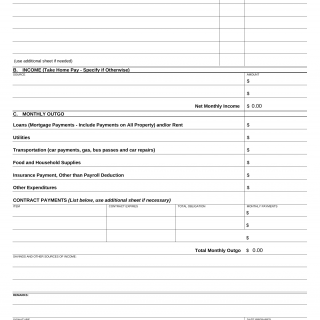

Form LIC 420 is used in California to provide budget information for licensed facilities or programs. The main purpose of this form is to outline the projected income and expenses for a specific period, typically on an annual basis.

The form consists of sections where the licensee provides detailed information related to the budget. This may include revenue sources (such as fees or grants), anticipated expenses (such as salaries, rent, utilities, and supplies), and any other relevant financial details. The form may also incorporate spaces for explanations or justifications of specific budget items.

Important fields on this form include accurately documenting the revenue and expense projections, ensuring accuracy in calculations and recording, considering any regulatory requirements or guidelines regarding budgeting, and providing clear explanations or justifications for budgeted amounts. It is crucial for the licensee to carefully review and analyze their financial needs when completing the form in order to create a realistic and comprehensive budget.

Application Example: A non-profit organization operating a community center in California completes Form LIC 420 to develop an annual budget. The form would include projections for income sources (such as donations and program fees) and expected expenses (such as staff salaries, facility maintenance, and program costs). By completing the form, the licensee can effectively plan and manage their financial resources and demonstrate financial viability to potential funders or stakeholders.

Related Forms: There are no specific related forms mentioned for Form LIC 420. However, other financial planning or reporting forms may be required to provide a comprehensive view of the licensee's financial situation.