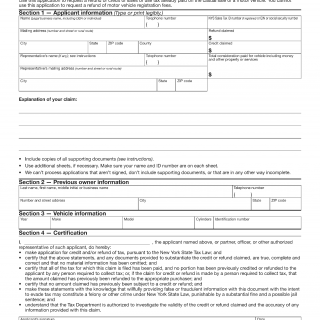

Form DTF-806. Application for Refund or Credit of Sales or Use Tax Paid on a Casual Sale of Motor Vehicle

Form DTF-806 is an application used for requesting a refund or credit of sales or use tax paid on a casual sale of a motor vehicle. The main purpose of this form is to help individuals who have purchased a motor vehicle from a private seller and have paid sales or use tax on the vehicle. The form consists of several important fields, including the name and address of the applicant, the make and model of the vehicle, the purchase price, and the amount of sales or use tax paid.

The parties involved in this form are the individual who purchased the vehicle and the state government, which collects the sales or use tax. When writing this form, it is important to have the purchase price and amount of tax paid on hand, as well as any relevant documentation such as a bill of sale or registration.

Application examples of this form include individuals who have purchased a motor vehicle from a private seller and have paid sales or use tax on the vehicle. Practice and use cases include individuals who have moved to a new state and are required to register their vehicle, as well as individuals who have purchased a vehicle from a private seller and have paid sales or use tax in error.

Strengths of this form include its ability to help individuals recover sales or use tax paid in error, while weaknesses include the potential for delays in processing and receiving the refund or credit. Opportunities for improvement include streamlining the application process and reducing processing times, while threats include potential fraud or misuse of the form.

Related forms include Form DTF-804, which is used for requesting a refund or credit of sales or use tax paid on a motor vehicle purchased from a registered dealer. Analogues to this form include requesting a refund or credit of sales or use tax paid on other types of purchases or transactions.

The form affects the future of the participants by providing a refund or credit of sales or use tax paid on a casual sale of a motor vehicle, which can help individuals save money and reduce their financial burden. The form is typically submitted to the state government agency responsible for collecting sales or use tax, and is stored in the agency's records for future reference.