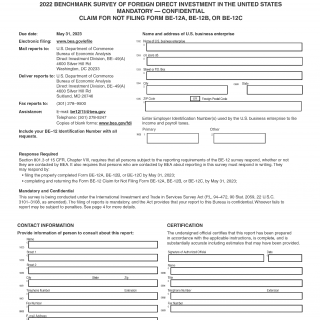

Form BE-12. Claim for Not Filing

Form BE-12 is a mandatory, confidential survey conducted by the US Bureau of Economic Analysis (BEA) to collect information on Foreign Direct Investment (FDI) in the United States. The form is used to gather information about the financial and operating performance of foreign-owned businesses in the US.

The purpose of Form BE-12 is to track the impact of FDI on the US economy and to provide policymakers with accurate data for decision-making purposes. The form consists of three variations: BE-12A, BE-12B, and BE-12C, which are designed for different types of reporting companies based on their size and level of foreign ownership.

Important fields that need to be completed when filling out the form include the company's name and address, industry classification, ownership structure, assets and liabilities, income and expenses, employment data, and details of transactions between foreign affiliates and their US parents.

Parties required to file Form BE-12 include all US entities that are directly or indirectly owned by foreign entities, including corporations, partnerships, LLCs, and sole proprietorships. Failure to file can result in significant penalties and fines.

To complete the form, respondents may need to provide supporting documentation such as financial statements, tax returns, and other reports. The form must be certified by an authorized officer of the reporting company.

Examples of situations where Form BE-12 may be required include when a foreign entity acquires a US business, when a US entity establishes operations abroad, or when there are significant changes in the ownership structure of a US entity.

Strengths of Form BE-12 include its ability to provide policymakers with accurate data on the impact of FDI on the US economy, while weaknesses include the potential burden of compliance on reporting companies.

Alternative forms to BE-12 include the BE-13 and BE-15 surveys, which are also used to collect information on FDI in the US, but with different reporting requirements and thresholds.

Once completed, the form can be submitted electronically through the BEA's eFile system or by mail. The information provided in the form is confidential and stored securely by the BEA.

Overall, Form BE-12 plays a critical role in tracking the impact of FDI on the US economy and helps inform policymakers in making informed decisions related to international trade and investment.