Per Diem form

A per diem form is a document used for reimbursing employees for meals and lodging expenses incurred while traveling for business purposes. The main purpose of the form is to provide a record of the expenses incurred by the employee while traveling for work.

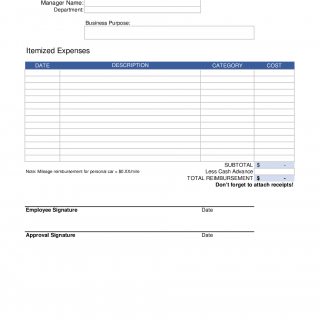

The form consists of several parts, including the employee's personal information, the date and time of travel, the destination, the purpose of the trip, and the amount of the per diem allowance. Important fields to consider when compiling the form include the date and time of travel, the destination, and the purpose of the trip.

The parties involved in the form are the employee who incurred the expenses while traveling for business purposes and the employer who is responsible for reimbursing the employee. Data required when compiling the form includes the date and time of travel, the destination, and the purpose of the trip. Documents that must be attached additionally include receipts for meals and lodging expenses.

Application examples and use cases of the per diem form include business travelers who need to stay overnight in a hotel and who need to eat meals while traveling. Benefits of the form include ensuring that employees are reimbursed for expenses incurred while traveling for business purposes, which can help to retain employees and improve morale. Challenges and risks associated with the form include the potential for fraudulent claims and the need for accurate record-keeping.

Related and alternative forms to the per diem form include the mileage reimbursement form and expense report forms. The mileage reimbursement form is used to reimburse employees for driving expenses, while expense report forms are used to document all business expenses, including travel expenses. The main difference between the per diem form and these forms is that the per diem form is specifically for reimbursing employees for meals and lodging expenses.

The per diem form affects the future of the participants by ensuring that employees are reimbursed for expenses incurred while traveling for business purposes, which can help to retain employees and improve morale. The form is typically submitted to the employer's accounting or finance department for processing and is stored in the employee's personnel file.