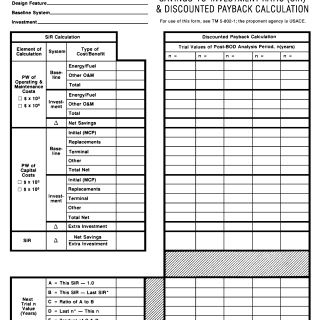

DA Form 5605-1-R. Life Cycle Cost Analysis Savings-to-Investment Ratio (Sir) & Discounted Payback Calculation (LRA)

DA Form 5605-1-R is a document used for conducting Life Cycle Cost Analysis (LCCA) calculations, specifically the Savings-to-Investment Ratio (SIR) and Discounted Payback Calculation (LRA).

The form consists of sections where financial data related to a project or investment is entered. It includes fields for initial investment costs, operational and maintenance expenses, and the expected project lifespan. The form calculates the SIR and LRA based on these inputs.

Important fields in this form include the initial investment amount, annual operational and maintenance costs, expected project lifespan, and the applicable discount rate. Accurate completion of this form is critical for evaluating the financial viability of a project or investment over its lifecycle.

Application Example: A business considering a new project completes DA Form 5605-1-R to assess its financial feasibility. By inputting accurate cost data and utilizing the calculated SIR and LRA values, the company can make informed decisions about whether to proceed with the project, considering its potential long-term returns.