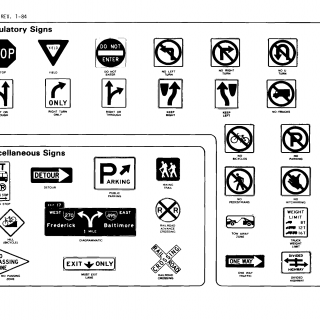

CT DMV Form R17. Road signs

Form Q20 - Use Tax Exemption on Motor Vehicles or Vessels Sold to or by Businesses serves as an exemption form used by businesses in Connecticut to claim a use tax exemption when transferring ownership of motor vehicles or vessels. This form is used to document tax-exempt transactions involving businesses.

Businesses in Connecticut that are involved in transactions where motor vehicles or vessels are sold, purchased, or transferred use this form to claim a use tax exemption if the transaction qualifies. The form helps businesses accurately report tax-exempt sales or transfers.

Form Structure

This form involves businesses, buyers or sellers of motor vehicles or vessels, and the Connecticut DMV. It's structured with sections that collect information about the business, the buyer or seller, details of the transaction, and the basis for claiming the exemption.

How to Fill Out and Submit the Form

Businesses complete the form with their business information, details about the transaction, and the basis for the use tax exemption claim. Once completed, the form is submitted to the DMV along with the other transaction documents.

Similar forms might include tax exemption forms for other types of transactions or taxes, each serving the purpose of documenting tax-exempt transactions.