Request of Account Termination

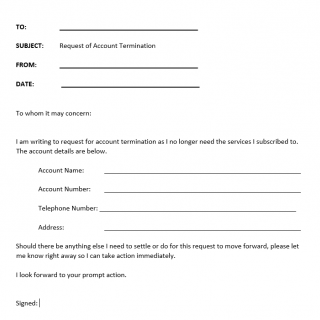

A Request of Account Termination is a written form filled out by a customer or an account holder to request the termination or closure of their account. It is mainly used for financial or banking-related services. Here is a detailed description of this document:

1. Items and Fields:

The Request of Account Termination generally comprises the following fields:

- Name and contact details of the account holder

- Account/Client/Subscriber number

- Account type

- Account closure date

- Reason for account closure

- Signature of the account holder

2. When it is necessary to draw up and fill it out:

The Request of Account Termination is necessary when a customer decides to close or terminate their account. This could be due to various reasons such as the account holder moving to a new location, switching to another financial institution, or any other personal or financial reasons.

3. Who makes it up and where does it go:

The Request of Account Termination is initiated by the account holder or authorized personnel of the account. It can be submitted in-person at the branch office, or sent by mail or email to the respective financial institution. Once received, the request is processed by the financial institution after verifying the details and fulfilling any essential procedural requirements.

4. What effect can it have in the future:

The effect of the Request of Account Termination is that the account holder’s relationship with the financial institution will be terminated. Funds, if any, left in the account will be settled and transferred as per the customer’s instruction. It is important to note that the closure of an account can affect the account holder's credit score, so it is essential to settle all financial liabilities or dues before requesting account termination.

5. Rules to follow when filling out to achieve the best result:

When filling out a Request of Account Termination, it is vital to ensure that all details provided are accurate and up-to-date. Any inconsistencies or incomplete fields could lead to delays or rejection of the request, leading to unnecessary frustration and inconvenience for the account holder. Additionally, it is essential to follow any specific instructions provided by the financial institution or regulatory body, such as providing relevant documentation or signatures.