OCFS-6060. Child Care Provider Attestation of Costs

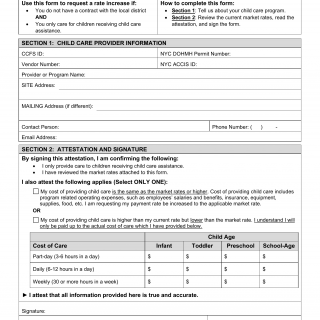

Form OCFS-6060, titled "Child Care Provider Attestation of Costs," is a document used by child care providers in New York State to report their operating costs and expenses related to providing child care services. The main purpose of this form is to collect financial information from child care providers, which is essential for program monitoring, funding allocations, and reimbursement calculations.

The form consists of sections where the child care provider or program must provide their name, address, and contact information. It then includes sections where the provider must detail various expenses incurred in operating the child care program, such as rent, utilities, staffing costs, materials, and other essential expenditures. The form may also require the provider's tax identification number and signature to certify the accuracy of the information provided.

Important fields in this form include accurate and itemized reporting of the child care provider's operating costs. Accurate completion of this form is crucial as it ensures that the funding and reimbursement calculations are based on actual expenses incurred by the provider, allowing for fair and appropriate financial support.

Application Example: A family child care provider completes Form OCFS-6060, providing detailed information about their monthly operating expenses, including rent, utilities, insurance, and supplies. The completed form is then submitted to the appropriate agency for funding allocation and reimbursement calculations.

Additional Document Needed: Form OCFS-6060 is a stand-alone form used to report operating costs. Depending on the specific child care program or funding source, additional financial documentation or invoices may be required to support the reported expenses.

Related Form: There are no direct analogues to OCFS-6060, as it is a specific financial attestation form created by OCFS to collect information about child care provider expenses in New York State.

Alternative Form: Child care providers may need to provide financial information through other reporting or reimbursement forms depending on the funding source or child care program they participate in.