NYS DMV Form MV-202C. Commercial Vehicle Registration Fee Schedule and Use Tax Chart

Form MV-202C is a document provided by the New York State Department of Motor Vehicles (DMV) that outlines the registration fees and use tax rates applicable to commercial vehicles. This form serves as a fee schedule and tax chart for individuals or organizations registering commercial vehicles in the state of New York.

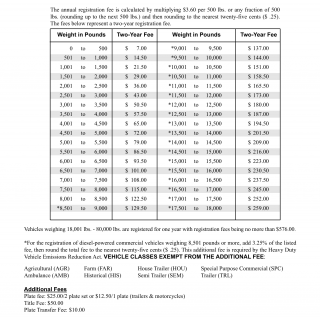

The form provides detailed information regarding the registration fees based on factors such as the weight, type, and usage classification of the commercial vehicle. It also includes the applicable use tax rates, which are calculated based on the purchase price or fair market value of the vehicle.

Individuals or organizations can refer to Form MV-202C to determine the registration fees and use tax obligations for their specific commercial vehicle registration transactions. By consulting this form, they can ensure compliance with the required fees and taxes as mandated by the DMV.

Related Forms: For updates or additional information regarding registration fees and use taxes for commercial vehicles, individuals should refer to the "Registration Fees and Use Taxes for Commercial Vehicles" document, which supplements Form MV-202C and provides the latest updates and guidelines.