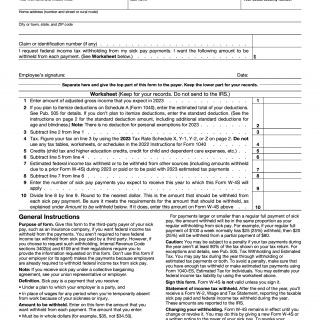

IRS Form W-4S. Request for Federal Income Tax Withholding from Sick Pay

IRS Form W-4S, also known as "Request for Federal Income Tax Withholding from Sick Pay," serves the purpose of ensuring accurate federal income tax withholding from sick pay received. This form is primarily used by individuals who receive sick pay and want to have taxes withheld from their payments.

The form consists of several sections that require specific information to be provided. These sections include personal information such as name, address, and Social Security number. It also asks for details about the payer of the sick pay, including their name, address, and federal identification number. Additionally, the form requires the recipient to select their withholding preferences and indicate any additional amounts they would like to withhold.

When filling out Form W-4S, it is important to consider factors such as your overall tax situation, anticipated sick pay amount, and any other sources of income. This will help ensure that the appropriate amount of tax is withheld to avoid underpayment or overpayment.

No additional documents need to be attached when submitting Form W-4S. However, it is essential to provide accurate information and review the form carefully before submission to minimize errors.

An example of an application scenario could be a person who is receiving long-term disability benefits due to illness or injury. By completing Form W-4S, they can specify the amount of federal income tax they wish to have withheld from their periodic sick pay, helping them manage their tax obligations efficiently.

It's worth noting that there are related forms available, such as Form W-4 for regular wages, which serves a similar purpose but for general employment income. Alternative analogues to Form W-4S may include state-specific tax withholding forms, as state tax withholding may also be applicable depending on the jurisdiction.

Once completed, the form can be submitted to the payer of the sick pay. The payer will then use the information provided to calculate and withhold the appropriate federal income taxes from the individual's sick pay. Copies of the form should be retained by both the recipient and the payer for record-keeping purposes.

In conclusion, IRS Form W-4S is a vital document used to request federal income tax withholding from sick pay. By accurately completing this form, individuals can ensure proper tax management when receiving sick pay and fulfill their tax obligations effectively.