Form LIC 9270. Form 7-1: Report On CCRC Monthly Care Fees - California

Form LIC 9270 is used in California by Continuing Care Retirement Communities (CCRCs) to report monthly care fees. This form is completed on a monthly basis by the CCRC operator or administrator.

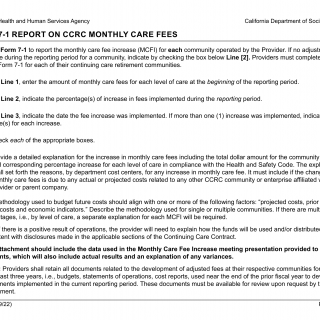

The form consists of sections that require information about the facility, including its name, address, license number, and the reporting month. The main part of the form focuses on reporting the monthly care fees charged to residents, including details such as resident names, types of care services provided, applicable rates, and any changes or adjustments made during the reporting period. The form may also include sections for reporting other financial information related to CCRC operations. Important fields include resident information, care fees charged, service details, and any necessary explanations or adjustments.

An application example of this form would involve a CCRC using Form LIC 9270 to report their monthly care fees to the California Department of Social Services. The CCRC operator or administrator would gather the necessary resident and financial information, accurately fill out the form based on the provided instructions, and submit it within the specified timeframe. By completing this form, CCRCs ensure transparency in their fee structures and comply with reporting requirements.

Related forms: A related form is Form LIC 9233, Report On Cost And Revenue - California, which is used by CCRCs to provide comprehensive cost and revenue information. While Form LIC 9270 specifically focuses on reporting monthly care fees, Form LIC 9233 provides a broader overview of the CCRC's financial performance, including expenses, revenue sources, and other relevant financial data. The main difference lies in the scope and focus of each form, with Form LIC 9270 capturing specific information on monthly care fees, while Form LIC 9233 offers a more comprehensive financial snapshot.