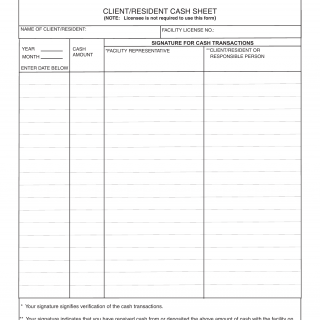

Form LIC 406. Client/Resident Cash Sheet - California

Form LIC 406 is used in California to maintain a record of client's or resident's cash transactions within licensed facilities or programs. The main purpose of this form is to track and document the flow of cash related to the client's or resident's personal funds.

The form consists of sections where the licensee records information about the client or resident and their cash transactions. This may include details such as the date, description of the transaction, whether it is an income or expense, the amount of cash involved, and any accompanying notes or explanations. The form may also provide running balances or totals for easier tracking.

Important fields on this form include accurately documenting the cash transactions, maintaining transparency and accountability in handling the client's or resident's funds, ensuring accuracy in calculations and recording, and complying with any regulations or guidelines regarding financial management. It is crucial for the licensee to establish proper procedures and controls to accurately complete the form and safeguard the client's or resident's cash.

Application Example: A nursing home facility in California uses Form LIC 406 to keep a detailed record of residents' cash transactions, such as payments for additional services, personal expenses, or refunds. By completing the form, the licensee provides a transparent overview of the resident's financial activities, promoting accurate accounting and responsible financial management.

Related Forms: There are no specific related forms mentioned for Form LIC 406. However, other financial record-keeping forms or documents may be required to track additional financial transactions within the licensed facility or program.