Form LIC 401A. Supplemental Financial Information - California

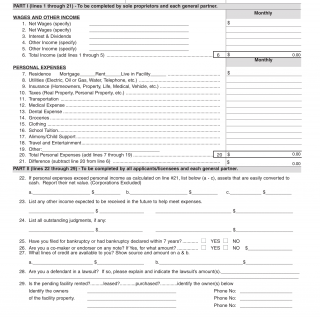

Form LIC 401A is used in California to provide supplemental financial information for licensed facilities or programs. The main purpose of this form is to gather additional details about the financial status and resources of the licensee.

The form consists of sections where the licensee provides information related to their financial situation. This may include details about their assets, liabilities, income sources, expenses, and other relevant financial data. The form may also request supporting documentation or references to substantiate the financial information provided.

Important fields on this form include accurately documenting the financial information, ensuring transparency and accuracy, and complying with any regulations or guidelines regarding financial reporting. It is crucial for the licensee to consider the completeness and accuracy of the provided information when filling out the form.

Application Example: A residential care facility in California undergoes a financial review as part of the licensing renewal process. Form LIC 401A would be used to provide detailed financial information, including balance sheets, income statements, and cash flow projections. By completing the form, the licensee demonstrates financial stability and compliance with the applicable requirements, facilitating the evaluation of their financial capacity to operate the facility.

Related Forms: There are no specific related forms mentioned for Form LIC 401A. However, other financial disclosure forms or documents may be required based on the type of facility or program and the regulatory requirements in place.